Market sentiment is a powerful indicator that reflects the collective mood or attitude of investors towards a specific market or asset. It plays a crucial role in driving financial markets by influencing buying and selling decisions based on the prevailing emotions of fear, greed, optimism, or pessimism. This guide delves into the nuances of market sentiment, exploring its impact on trading strategies and investment decisions.

What is Market Sentiment?

Market sentiment represents the overall sentiment of investors toward the future performance of the market or a particular asset. It is often described in terms of being bullish or bearish. Understanding market sentiment is essential for both short-term traders and long-term investors as it provides insights into potential market movements.

Exploring Types of Market Sentiment

Bullish Sentiment:

- When investors feel optimistic about the future direction of the market or a particular asset, it is known as bullish sentiment. This is often associated with expectations of strong economic performance, corporate profitability, and favorable geopolitical scenarios. Bullish sentiment can lead to increased buying activity, pushing prices upward.

Bearish Sentiment:

- Conversely, bearish sentiment prevails when investors are pessimistic and expect prices to decline. This could result from adverse economic indicators, geopolitical tensions, or market overvaluations. In such a climate, selling activity may increase, causing prices to fall.

Deep Dive into Market Sentiment Indicators

Understanding and measuring market sentiment involves several key indicators that provide traders and investors with a gauge of the market’s emotional climate:

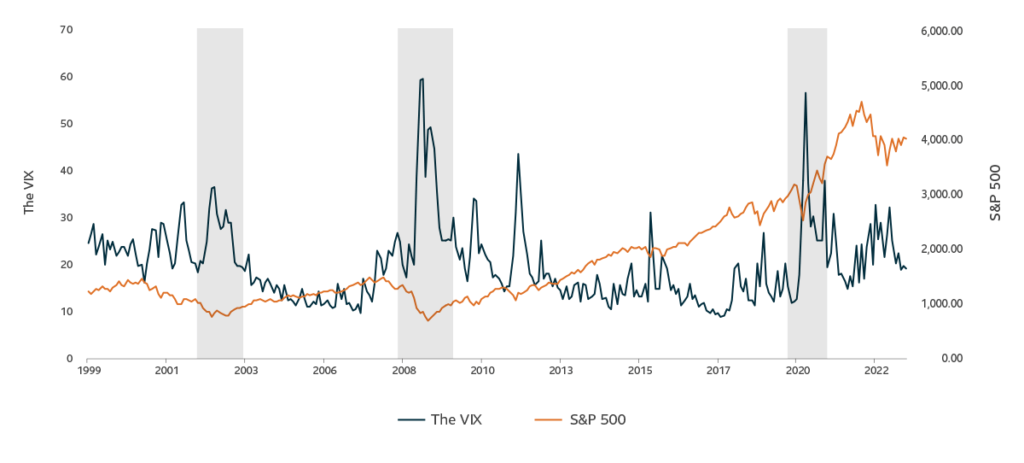

Volatility Index (VIX):

- Commonly known as the “fear index,” the VIX measures the market’s expectation of volatility and is a primary indicator used to sense the levels of fear or complacency in the market.

High-Low Index:

- This indicator compares the number of stocks hitting their 52-week highs to those hitting their 52-week lows, offering insights into the underlying strength or weakness of the market.

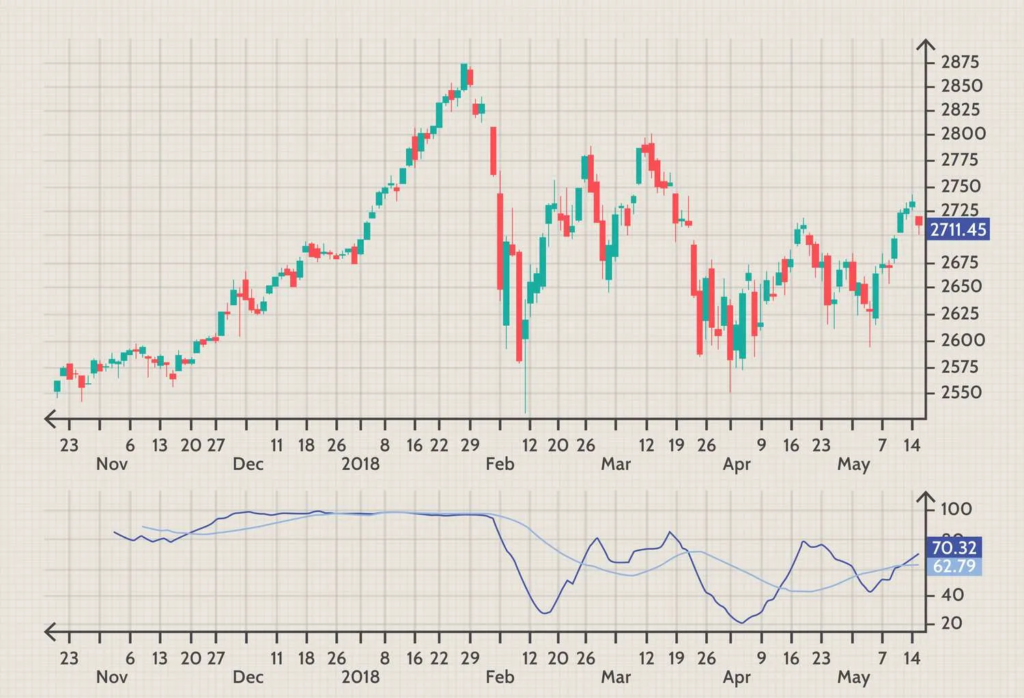

Moving Averages:

- Moving averages smooth out price data to form a trend following indicator that is crucial in determining the market’s momentum and sentiment shifts.

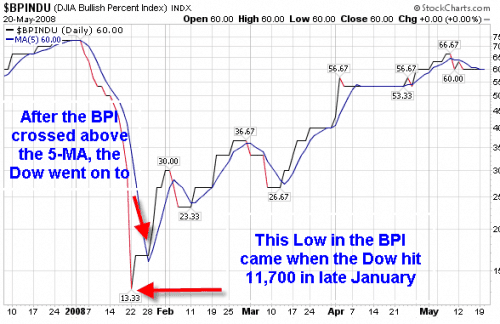

Bullish Percent Index (BPI):

- The BPI shows the percentage of stocks within an index that are on bullish patterns, helping investors understand the breadth of market optimism.

Put/Call Ratio:

- This ratio measures the volume of put options versus call options and can indicate the general mood in the markets; a higher ratio may signal bearish sentiment.

- CBOE Volatility Index (VIX) – Official Page

- Description: Learn more about the VIX, often referred to as the “fear gauge” of the market, directly from the Chicago Board Options Exchange.

- URL: CBOE VIX

- Investopedia – Market Sentiment

- Description: This resource provides a detailed explanation of market sentiment and its implications for trading.

- URL: Investopedia Market Sentiment

- Behavioral Finance: Insights from Kahneman and Tversky

- Description: Explore foundational concepts of behavioral finance as introduced by Daniel Kahneman and Amos Tversky.

- URL: Kahneman and Tversky Insights

- John Maynard Keynes and the Theory of Animal Spirits

- Description: An article discussing Keynes’s concept of “Animal Spirits” and its impact on economic and investing behaviors.

- URL: Keynes’s Animal Spirits

- Moving Averages – Technical Analysis

- Description: A guide to understanding how moving averages are used in the technical analysis of financial markets.

- URL: Moving Averages Guide

- High-Low Index – Market Indicator

- Description: An explanation and practical use of the High-Low Index as a market sentiment indicator.

- URL: High-Low Index Explanation

- Bullish Percent Index – Market Indicator

- Description: Detailed information on the Bullish Percent Index and how it is used to gauge market sentiment.

- URL: Bullish Percent Index Details

- StockGeist – AI Platform for Market Sentiment

- Description: Overview of StockGeist, an AI platform that monitors market sentiment through social media analysis.

- URL: StockGeist Platform

Behavioural Insights and Market Psychology

Market sentiment is intrinsically linked to behavioral finance, which studies how psychological influences and biases affect the financial behaviors of investors and the subsequent effects on market prices. Two theories highlight this phenomenon:

- Behavioral Financial Theory:

- Pioneered by Kahneman and Tversky, this theory explores how psychological factors affect market outcomes, such as investors overreacting to news or following trends despite contrary fundamental indicators.

- Animal Spirits:

- Coined by Keynes, this theory suggests that emotional factors can drive investor behavior, leading to fluctuations in market prices that do not always align with economic fundamentals.

Practical Applications of Market Sentiment

Investors can leverage sentiment analysis in various ways:

- Contrarian Investing: By going against the prevailing market sentiment, contrarian investors often buy when there is fear and sell when there is greed.

- Momentum Trading: Traders may use sentiment indicators to ride trends, entering trades based on established bullish or bearish sentiment.

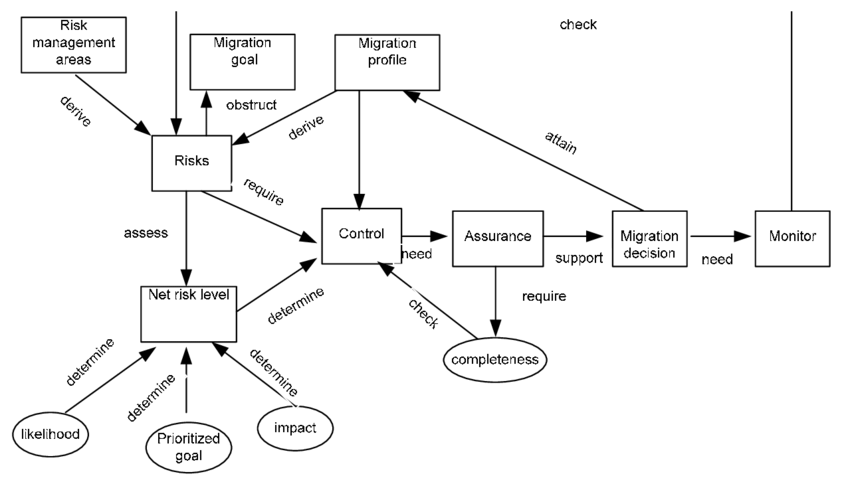

- Risk Management: Understanding market sentiment can help in adjusting risk levels, perhaps reducing position sizes when sentiment indicates heightened market volatility.

Interactive Elements and Real-Time Analysis

Interactive platforms like StockGeist offer real-time sentiment analysis, utilizing AI to parse vast amounts of data from social media and news outlets. These platforms provide a dynamic view of how sentiment is evolving in real-time, which is invaluable for day traders and online investors.

Conclusion

Market sentiment is a dynamic and multifaceted aspect of the financial markets that can offer significant insights into potential price movements. By understanding and effectively measuring market sentiment, investors and traders can enhance their strategies, align better with market dynamics, and potentially improve their investment outcomes.

FAQs About Market Sentiment

- What is the meaning of market sentiment?

- Market sentiment refers to the overall attitude of investors toward a particular security or the market, influenced by various economic, political, and psychological factors.

- How to use market sentiment in forex?

- In forex trading, market sentiment can indicate potential currency strength or weakness, which traders use to position themselves for upcoming movements.

- How do you analyze market sentiment?

- Analyzing market sentiment involves a combination of technical indicators like the VIX, sentiment surveys, market data analytics, and behavioral analysis.

- What is the best market sentiment indicator?

- The best market sentiment indicator varies by market and trader preference but often includes the VIX, put/call ratios, and the High-Low Index.

- What is the most powerful indicator in trading?

- While subjective, many traders find moving averages and the MACD among the most powerful tools for identifying trading opportunities based on sentiment trends.

- What is the current market sentiment?

- Current market sentiment can be assessed through real-time analytics platforms, market indicators, and news sentiment analysis to understand the prevailing mood of the market.