The energy industry is one of the most crucial industries in the world, and it is constantly evolving. It is important to stay ahead of the curve when it comes to energy information, and alternative data can help provide a competitive edge. Alternative data refers to data that is not traditionally used in financial analysis. This type of data is becoming increasingly important, and there are many providers that can help investors and business managers make informed decisions. In this article, we will discuss two alternative data providers for the energy industry.

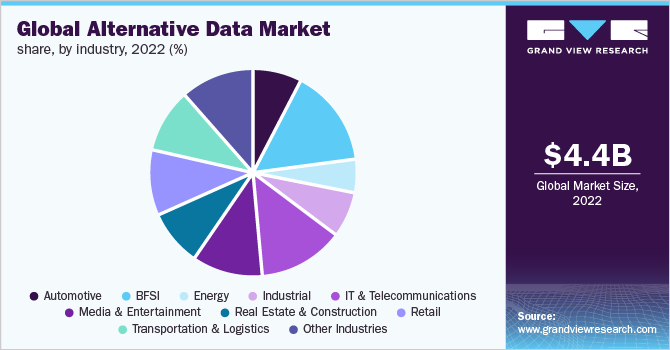

The image below shows how alternative data sources like GTCOM and Thasos can provide real-time insights into the energy industry, helping investors and business managers stay ahead of the curve. These insights can help identify emerging trends and opportunities that traditional data sources cannot provide.

Why is Alternative Data Important to the Energy Industry?

Alternative data is becoming increasingly important to the energy industry because it provides investors and business managers with real-time insights that traditional data sources cannot provide. Traditional data sources, such as financial reports, have a time lag that can make it difficult to make informed decisions. Alternative data sources, such as GTCOM and Thasos, provide real-time insights that can help investors and business managers stay ahead of the curve.

Additionally, the energy industry is constantly evolving, and alternative data sources can help investors and business managers identify emerging trends and technologies. For example, GTCOM’s platform can provide insights into emerging technologies in the energy industry, while Thasos’s platform can provide insights into the activity of various industries, including the energy industry.

GTCOM

Global Tone Communication (GTCOM) is a provider of news sentiment and event tracking across 65 languages. GTCOM’s platform uses natural language processing and machine learning to analyze news and events related to the energy industry. The platform can provide investors and business managers with real-time insights into the energy industry.

GTCOM’s platform can help investors and business managers identify trends and opportunities in the energy industry. For example, GTCOM’s platform can provide insights into the impact of geopolitical events on energy prices. The platform can also help investors and business managers identify emerging technologies in the energy industry.

Thasos

Thasos is another alternative data provider for the energy industry. This provides mobile phone location data dating back to 2015 that is transformed into information that can be easily consumed and acted upon by investors and business managers. Thasos offers three different streams of data: MallStreams (sold and distributed by Bloomberg), ConsumerStreams, and IndustrialStreams.

MallStreams provides insights into the foot traffic of shopping malls. This data can help investors and business managers identify trends in consumer behavior and predict the success of retail stores. ConsumerStreams provides insights into the foot traffic of various businesses, including gas stations, restaurants, and supermarkets. This data can help investors and business managers identify trends in consumer behavior and predict the success of businesses. IndustrialStreams provides insights into the activity of various industries, including the energy industry. This data can help investors and business managers identify trends and opportunities in the energy industry.

In conclusion, alternative data is becoming increasingly important to the energy industry. Providers like GTCOM and Thasos provide investors and business managers with real-time insights that traditional data sources cannot provide. As the energy industry continues to evolve, alternative data sources will become even more important for making informed decisions.