In today’s data-driven world, traditional data sources are no longer enough for businesses to make informed decisions, and this is especially true for the consumer industry. The industry has become increasingly competitive, and companies are constantly seeking new ways to gain a competitive edge. This is where alternative data comes in. In this article, we will explore what alternative data is, how it can benefit the consumer industry, and some potential providers of alternative data.

What is Alternative Data?

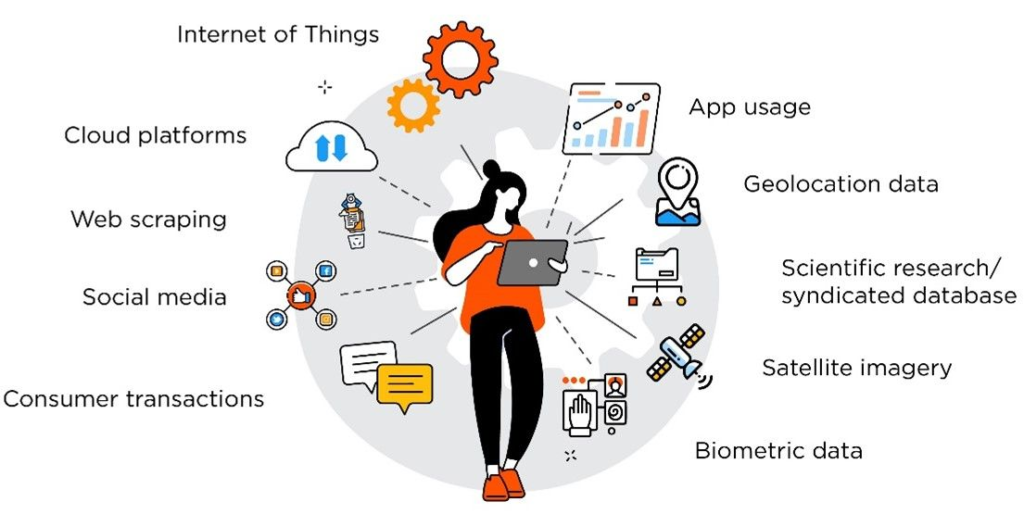

In simple terms, alternative data is any data that is not traditionally used by businesses to make decisions. This can include data from non-traditional sources such as social media, satellite imagery, web traffic, credit card transactions, and many more.

Why is Alternative Data Important to the Consumer Industry?

In today’s highly competitive consumer industry, businesses need to stay ahead of the curve to remain relevant. Alternative data provides businesses with a more comprehensive view of the market, customers, and competitors, allowing them to make more informed decisions about product development, marketing strategies, and risk management. By leveraging alternative data, businesses can gain a competitive edge and position themselves for long-term success.

Benefits of Alternative Data for the Consumer Industry

The consumer industry is constantly evolving, and businesses need to stay ahead of the curve to remain competitive. Here are some of the benefits of using alternative data in the consumer industry:

Better Market Insights

Alternative data provides businesses with a more detailed and complete view of the market. By analyzing social media trends, web traffic, and other non-traditional data sources, companies can gain valuable insights into consumer behavior and preferences.

Competitive Intelligence

With alternative data, businesses can gain a better understanding of their competitors. By tracking social media activity, web traffic, and other data sources, companies can monitor their competitors’ marketing strategies, product launches, and customer sentiment. This can help businesses identify gaps in the market and develop strategies to gain a competitive advantage.

Improved Risk Management

Alternative data can also help businesses manage risk more effectively. By analyzing non-traditional data sources such as credit card transactions, businesses can detect fraud and assess credit risk more accurately. This can help reduce losses and improve overall profitability.

Potential Providers of Alternative Data

There are many providers of alternative data, each with their own unique strengths and specialties. Here are some potential providers of alternative data for the consumer industry:

Estimize

Estimize provides consensus estimates on public companies provided by both buy-side and sell-side analysts. By aggregating and analyzing this data, Estimize provides businesses with a more accurate view of market expectations for earnings and revenue.

M Science

M Science provides data-driven research and analytics with verifiable accuracy. The company specializes in providing insights into consumer behavior and preferences, and offers a range of data sets that can be used to inform business decisions.

Conclusion

Alternative data is becoming increasingly important for businesses across all industries, and the consumer industry is no exception. By providing businesses with a more comprehensive view of the market, customers, and competitors, alternative data can help companies gain a competitive advantage and position themselves for long-term success.