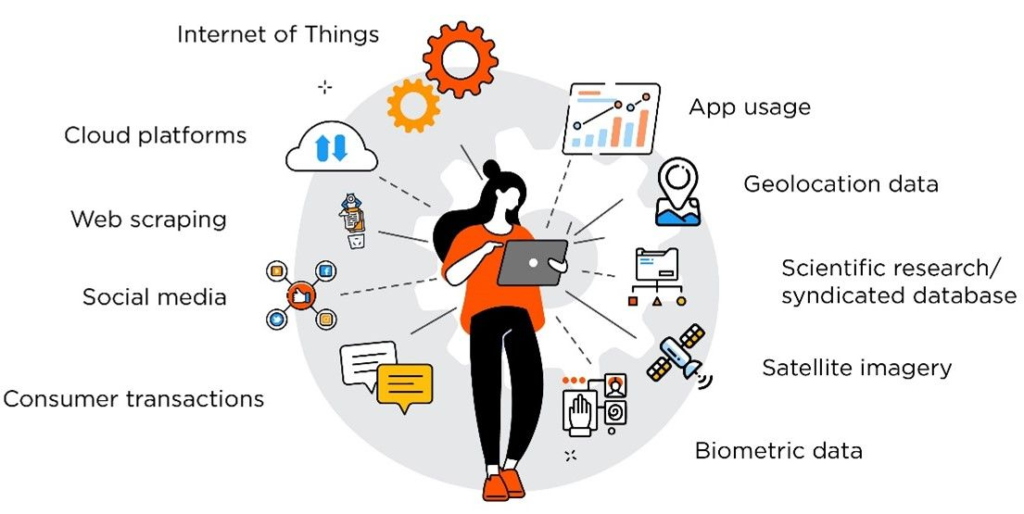

In recent years, alternative data has emerged as a valuable resource for the financial services industry. Unlike traditional financial data, alternative data refers to information that is not typically found in financial statements or other structured data sources. Instead, alternative data encompasses a range of unstructured data sources, such as social media, satellite imagery, and web traffic.

What is Alternative Data?

Alternative data refers to any data that is not typically found in financial statements or other structured data sources. This could include information such as social media activity, satellite imagery, or web traffic. The rise of big data has made it easier than ever for financial services firms to access and analyze large amounts of unstructured data.

The Importance of Alternative Data for Financial Services

Alternative data is important for financial services firms for several reasons. First, alternative data can provide insights into consumer behavior and market trends that are not available through traditional financial data sources.

As the demand for alternative data has grown, so too has the number of alternative data providers. Some of the most prominent alternative data providers include:

Quandl

Quandl is a platform for data that delivers a suite of unique, non-market data products atop a strong base of core financial and economic data. The platform offers access to a wide range of alternative data sources, including social media sentiment, web traffic, and satellite imagery.

AnthemData

AnthemData specializes in providing data on live-streaming (DAU, number of paying users, ARPU) and music & audio (paid subscriptions, digital album sales, and virtual gift income) in China. By providing access to this type of data, AnthemData enables financial services firms to gain a better understanding of consumer behavior and market trends in China.

Conclusion

Alternative data has emerged as a valuable resource for the financial services industry. By providing access to new and unique sources of data, alternative data providers enable financial services firms to gain a better understanding of consumer behavior, identify investment opportunities, and enhance risk management practices. As the demand for alternative data continues to grow, it is likely that we will see even more innovative uses of this data in the years to come.