The Cable/Internet/Satellite industry is a dynamic and rapidly evolving sector. With the advent of new technologies, changing consumer preferences, and the entry of new players in the market, businesses operating in this industry need to stay up-to-date with the latest trends to remain competitive. One way to achieve this is by leveraging alternative data providers to gain insights that are not available from traditional sources.

What is Alternative Data?

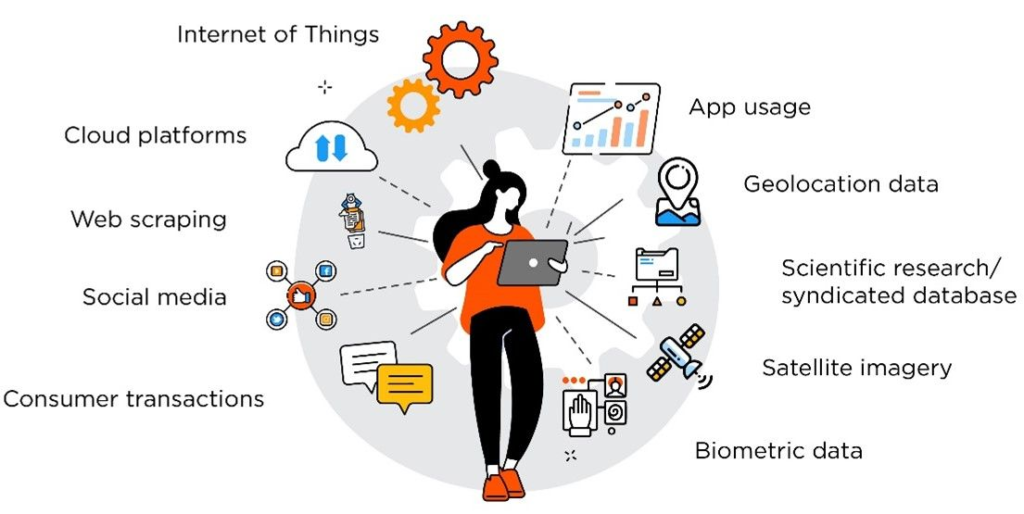

Alternative data refers to any information that is not obtained from conventional sources such as financial statements, market reports, or news articles. Instead, alternative data providers collect and analyze data from a variety of sources, including social media, web scraping, satellite imagery, and more. This data can be used to uncover patterns, trends, and insights that are not evident from traditional data sources.

Why Alternative Data Matters for Cable/Internet/Satellite Industry

Alternative data has become increasingly important for businesses operating in the Cable/Internet/Satellite industry for several reasons. Firstly, the industry is highly competitive, and gaining a competitive edge requires access to accurate and timely information. Secondly, traditional data sources such as financial statements and market reports may not provide a complete picture of the industry. Thirdly, the industry is subject to rapid change, and traditional data sources may not be able to keep up with the pace of change.

Estimize: Crowdsourcing Financial Estimates

One of the most popular alternative data providers is Estimize. The platform provides consensus estimates on public companies provided by both buy-side and sell-side analysts. What makes Estimize unique is that it crowdsources its data from a wide range of contributors, including hedge funds, independent analysts, and individual investors. The platform provides a more accurate and comprehensive view of a company’s financial health than traditional sources such as Wall Street analysts.

Cable/Internet/Satellite businesses can use Estimize’s data to make better investment decisions and to gain insights into their competitors’ financial performance. For example, Estimize’s data can be used to track revenue growth, earnings per share (EPS), and other financial metrics. This information can help businesses make informed decisions about which companies to invest in and which ones to avoid.

Thinknum: Web Scraping for Market Insights

Another alternative data provider that is gaining popularity in the Cable/Internet/Satellite industry is Thinknum. The platform specializes in web data and indexes and aggregates web data onto a single platform, making it easy for Cable/Internet/Satellite businesses to access and analyze the data. Thinknum’s data covers a wide range of topics, including social media activity, job postings, and product reviews.

Cable/Internet/Satellite businesses can use Thinknum’s data to gain insights into consumer behavior and to monitor changes in the competitive landscape. For example, businesses can use Thinknum’s data to track social media mentions of their products and services, monitor job postings by their competitors, and analyze product reviews to identify areas for improvement.

Conclusion

Alternative data has become increasingly important for Cable/Internet/Satellite businesses looking to gain a competitive edge in a rapidly changing market. Platforms such as Estimize and Thinknum provide valuable insights that are not available from traditional data sources. By leveraging alternative data, businesses can make more informed decisions and stay ahead of the curve in this highly competitive industry.