The restaurant and food delivery industry is highly competitive, with new establishments opening every day. To stay ahead of the competition, it is essential to have access to reliable data that provides insights into consumer preferences and trends. While traditional data sets such as sales figures and foot traffic can provide valuable insights into consumer behavior, they only tell part of the story. Alternative data sets such as credit and debit bill pay data and news sentiment tracking can provide a more complete understanding of consumer preferences and trends.

In this article, we will explore two providers of alternative data for the restaurant and food delivery industry. We will also discuss why this type of data is so important and how leveraging this data can help restaurant owners and food delivery companies stay ahead of the curve.

What is Alternative Data?

Alternative data sets refer to non-traditional sources of data that can provide insights into consumer behavior and trends. In the context of the restaurant and food delivery industry, alternative data sets can include credit and debit bill pay data, news sentiment tracking, and social media analytics, among others. By leveraging these data sets, restaurant owners and food delivery companies can gain a more complete understanding of consumer preferences and trends, allowing them to make informed decisions about where to invest their resources and how to adjust their offerings to meet changing consumer demand.

Why Alternative Data is Important for Restaurant & Food Delivery

Alternative data provides a more complete picture of consumer behavior than traditional data sets. By leveraging this data, restaurant owners and food delivery companies can make informed decisions about where to invest their resources and how to adjust their offerings to meet changing consumer demand.

For example, if a restaurant owner notices a decline in sales for a particular dish, they can use the data provided by Earnest Research and GTCOM to identify the reason for the decline. Perhaps the dish is too expensive compared to similar offerings at other restaurants, or maybe consumers are concerned about the ingredients used in the dish. Armed with this information, the restaurant owner can make changes to their menu or adjust their pricing to better meet consumer demand.

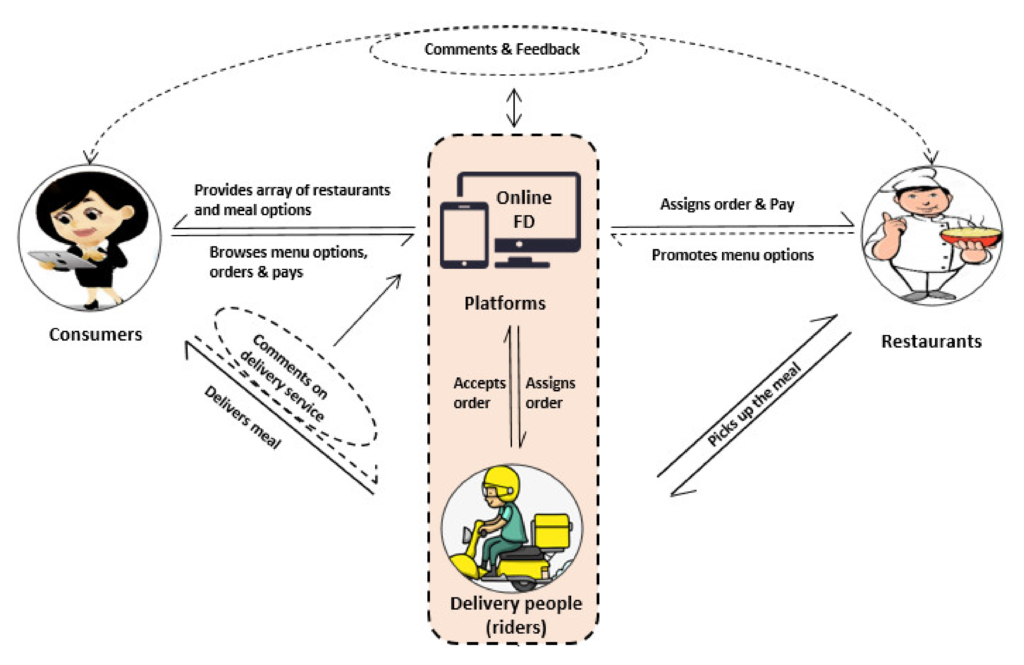

Understanding consumer sentiment is also important in the food delivery industry. With the rise of third-party delivery services such as Uber Eats and Grubhub, it is essential to provide a positive customer experience to remain competitive. By leveraging alternative data sets, food delivery companies can identify areas where they may need to improve their offerings or customer service, ultimately leading to an increase in customer satisfaction and loyalty.

Earnest Research

Earnest Research is a data analytics company that provides insights into consumer behavior using credit and debit bill pay data from millions of anonymous US consumers. By analyzing this data, Earnest Research can provide insights into consumer spending habits, including where consumers are spending their money and how much they are spending.

For the restaurant and food delivery industry, this type of data can be incredibly valuable. For example, Earnest Research can provide insights into which restaurants are experiencing growth or decline in sales. This can help restaurant owners make informed decisions about where to open new locations or where to invest their marketing efforts. Additionally, Earnest Research can provide insights into which types of food are becoming more or less popular. This can help restaurants adjust their menu offerings to better meet consumer demand.

With this data, restaurant owners can also identify which items on their menu are driving the most revenue and which are not. By understanding which dishes are most popular, they can optimize their menu offerings and better tailor their marketing efforts based on the data provided. This type of data can also help restaurant owners identify which days of the week or times of day are busiest, allowing them to adjust their staffing and inventory accordingly.

Global Tone Communication (GTCOM)

Global Tone Communication (GTCOM) is a data analytics company that provides news sentiment and event tracking across 65 languages. By analyzing news articles and social media posts, GTCOM can provide insights into consumer sentiment and trends.

For the restaurant and food delivery industry, this type of data can be incredibly valuable. GTCOM can provide insights into consumer sentiment around specific restaurants or food delivery services. This can help restaurant owners and food delivery companies identify areas where they may need to improve their offerings or customer service. Additionally, GTCOM can provide insights into broader trends in the industry, such as the rise of plant-based diets or the popularity of certain types of cuisine.

With GTCOM’s data, restaurant owners can also identify which marketing campaigns are most effective in driving traffic to their establishment. By understanding consumer sentiment towards their brand, they can tailor their messaging to better resonate with their target audience.

Conclusion

In conclusion, alternative data is becoming increasingly important in the restaurant and food delivery industry. Providers such as Earnest Research and GTCOM can offer valuable insights into consumer behavior and trends, helping restaurant owners and food delivery companies stay ahead of the competition. By leveraging this type of data, restaurant owners and food delivery companies can make informed decisions about where to invest their resources and how to adjust their offerings to meet changing consumer demand. The future of the industry belongs to those who can use data to their advantage, and alternative data is an essential tool in achieving that goal.