ExtractAlpha tracks the overall sentiment of Japanese and Chinese equity markets every quarter using our proprietary NLP model applied to earnings call transcripts supplied by SCRIPTS Asia. The transcripts analyze the sentiment recorded from company management and sell side analysts.

Past quarter-over-quarter changes in the overall earnings call transcript sentiment have been correlated with future quarter-over-quarter changes in index levels in the Japanese market, with a correlation of 0.15 (the correlation is even higher for the Chinese market, at 0.37). This indicates that management’s outlooks on their own stock and the Japanese economy as a whole have predictive value and can be aggregated to the market level to use as early indicators of market regime shifts, or to the sector level to inform rotation strategies.

Japanese Market Sentiment

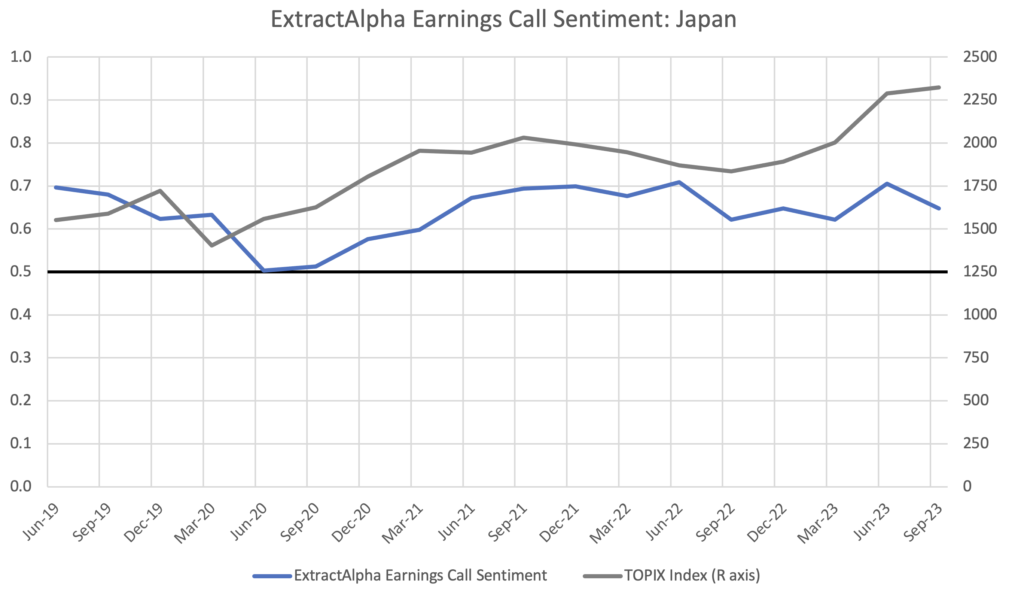

Below, we plot the sentiment (with 0.5 being neutral) versus the TOPIX index from the second quarter of 2019 through the present.

Although sentiment in Japan remains much higher than during the COVID period, it has pulled back significantly relative to Q2, indicating a less-positive outlook by companies and analysts and a possible continued pullback in the Japanese market for the rest of Q4.

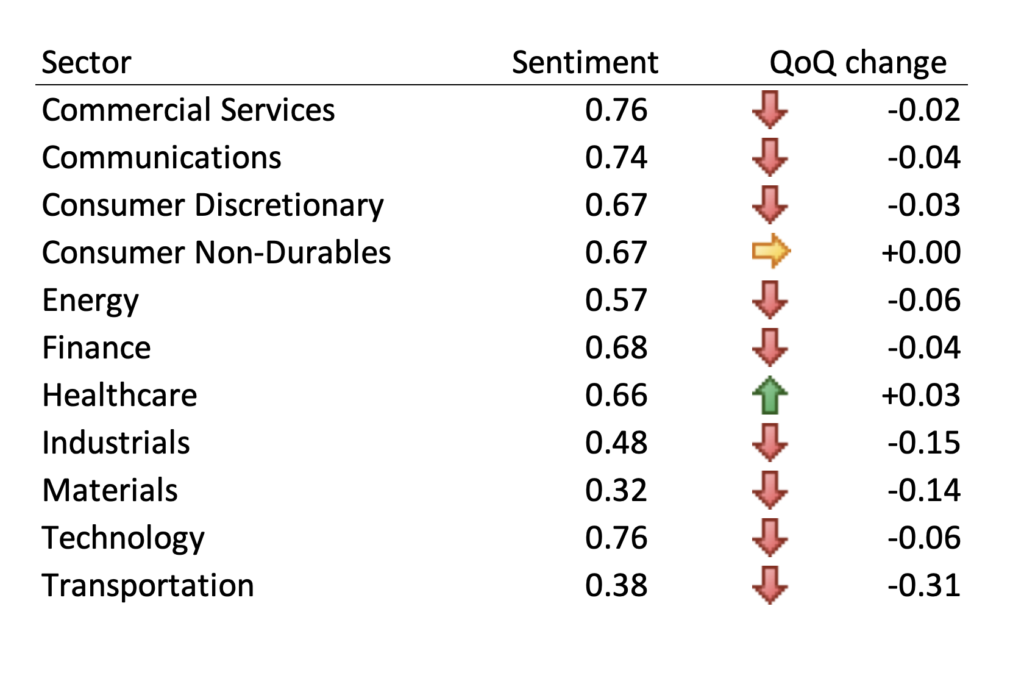

As the table below shows, the drop in sentiment was driven primarily by significant decreases in the Materials, Transportation, and Industrial sectors, with most other sectors experiencing a small decrease. Healthcare and Consumer Non-Durables were the only sectors to hold steady or experience slight increases in sentiment.

Chinese Market Sentiment

Next, we’ll publish our Earnings Call Sentiment report for the Chinese market.

In Summary

ExtractAlpha’s Transcripts Model Asia dataset provides valuable insights into the outlook of Japanese and Chinese equities. It can be used to identify early warning signs of market regime shifts and to inform sector rotation strategies.

For more information on the Transcripts Model Asia which underpins these aggregates, please reach out to us.