Introduction

In the competitive landscape of financial markets, having access to comprehensive and timely information is crucial. While traditional data such as market trends and economic indicators remain vital, alternative data has emerged as a transformative tool for market analysts. This article explores the role of alternative data in market analysis, identifying its sources, advantages, challenges, and the revolutionary potential it offers for forecasting and strategy development.

What is Alternative Data?

Alternative data encompasses information not typically included in standard financial analyses but that offers additional insights into market conditions and trends. This data can be derived from various non-traditional sources, providing a unique perspective on the dynamics affecting the markets.

Key Sources of Alternative Data for Market Analysis

- Satellite Imagery: Used to count cars in retail parking lots or measure oil reserves.

- Social Media Sentiment: Tracks public sentiment and trends affecting consumer behaviors and stock movements.

- Mobile App Usage: Provides insights into consumer preferences and brand engagement.

- Credit Card Transaction Data: Offers real-time data on consumer spending habits and economic health.

Benefits of Alternative Data in Market Analysis

Enhanced Forecasting Abilities

Alternative data provides earlier signals of market shifts, allowing analysts to forecast trends and market reactions more accurately.

Deeper Market Insights

This data can reveal hidden patterns and relationships that are not observable through traditional data, leading to a more comprehensive understanding of market forces.

Competitive Advantage

Analysts equipped with insights from alternative data can advise and make decisions with a level of detail and foresight unavailable to those relying solely on standard data sources.

Challenges in Utilizing Alternative Data

Data Management and Analysis Complexity

The sheer volume and variety of alternative data require sophisticated tools and techniques for effective processing and analysis.

Cost and Accessibility

High-quality alternative data can be expensive and difficult to access, posing a barrier for smaller firms or individual analysts.

Legal and Ethical Considerations

Navigating the legal implications of using personal and proprietary data is essential to comply with privacy laws and ethical standards.

Case Studies

Market analysts at leading financial institutions and consulting firms use alternative data to enhance their market predictions. For instance, by analyzing traffic patterns and satellite images, analysts can predict a retailer’s sales performance before official reports are released.

Future of Alternative Data in Market Analysis

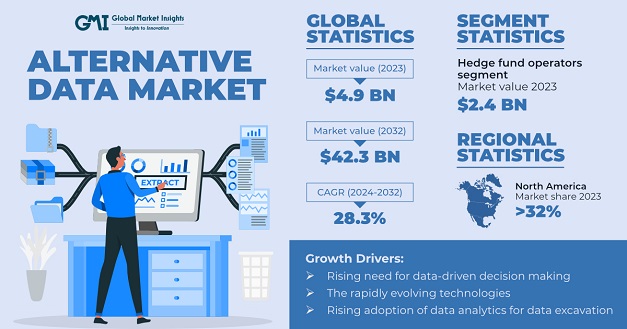

The role of alternative data in market analysis is expected to grow, driven by advancements in data analytics technologies and an increasing awareness of its benefits. This evolution will likely continue to shape the strategies and success of businesses and investors in the financial markets.

Extract Alpha

Extract Alpha datasets and signals are used by hedge funds and asset management firms managing more than $1.5 trillion in assets in the U.S., EMEA, and the Asia Pacific. We work with quants, data specialists, and asset managers across the financial services industry.

Conclusion

Alternative data is reshaping the field of market analysis, offering new insights and opportunities for those willing to embrace its potential. As the availability and sophistication of this data increase, it will become an integral part of market analysis, pushing the boundaries of traditional financial metrics and strategies.

Commonly Asked Questions by Market Analysts

- How can market analysts integrate alternative data into their existing workflows?

- Analysts can start by incorporating alternative data into specific areas of their analysis to complement traditional metrics and gradually expand its use as they gain confidence in interpreting this data.

- What are the best practices for ensuring the reliability of alternative data?

- Verifying the source, performing rigorous data quality checks, and cross-referencing with traditional data are essential steps to ensure the reliability of alternative data.

- Can alternative data replace traditional market analysis methods?

- While alternative data can significantly enhance market analysis, it is best used in conjunction with traditional methods to provide a well-rounded analytical approach.

- What technologies are essential for analyzing alternative data effectively?

- Advanced data analytics and processing software, including AI and machine learning tools, are crucial for handling the complexity and volume of alternative data.

- What ethical considerations should analysts keep in mind when using alternative data?

- Analysts should adhere to privacy laws and ethical standards concerning data use, especially when handling sensitive information that could impact market perceptions or individual privacy.