Introduction

In an era where data is the new currency, data aggregator data sets play a pivotal role in the business and technology landscapes. These data sets compile information from various sources into comprehensive, usable formats that drive decision-making across industries. This article explores the significance of data aggregator data sets, their key sources, benefits, and challenges, as well as their transformative impact on business intelligence and analytics.

What is a Data Aggregator Data Set?

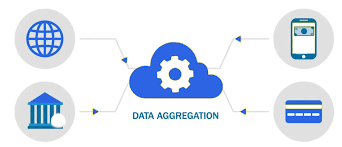

Data aggregators collect information from multiple sources, often across different sectors and platforms, to create unified data sets that provide more extensive insights than any single source could offer. These data sets are used for analytics, forecasting, and strategic planning.

Key Sources of Data for Aggregators

- Public Records: Government databases, legal filings, and official registries.

- Social Media: User-generated content, trends, and engagement metrics.

- E-commerce Platforms: Purchase histories, product reviews, and consumer behavior data.

- IoT Devices: Data generated from connected devices in various industries.

Benefits of Data Aggregator Data Sets

Enhanced Decision Making

With comprehensive views of data from multiple sources, businesses can make more informed decisions, reducing risks and identifying opportunities more effectively.

Improved Customer Insights

Aggregated data provides deeper insights into customer behaviors and preferences, enabling more targeted marketing and product development strategies.

Operational Efficiency

By integrating data from various sources, companies can streamline operations, reduce redundancies, and optimize performance across departments.

Competitive Advantage

Access to diverse and comprehensive data sets can give businesses a competitive edge in market analysis and trend forecasting.

Challenges in Utilizing Data Aggregator Data Sets

Data Quality and Consistency

Ensuring data accuracy and consistency across multiple sources can be challenging, requiring robust validation processes.

Privacy and Compliance Issues

Navigating the complex landscape of data privacy laws and regulations is crucial to maintaining legal compliance and protecting user privacy.

Integration Complexity

Merging and harmonizing data from various sources often requires sophisticated technology and expertise.

Case Studies

Financial institutions use data aggregator data sets to assess credit risk by compiling data from various financial behaviors and transaction histories. Marketing firms leverage these data sets to create detailed customer profiles that inform personalized advertising strategies.

Future of Data Aggregator Data Sets

The role of data aggregators is expected to expand, driven by the growing availability of data and advancements in data processing technologies. As businesses become more data-driven, the demand for integrated and actionable data sets will increase, highlighting the importance of effective data aggregation.

Extract Alpha

Extract Alpha datasets and signals are used by hedge funds and asset management firms managing more than $1.5 trillion in assets in the U.S., EMEA, and the Asia Pacific. We work with quants, data specialists, and asset managers across the financial services industry.

Conclusion

Data aggregator data sets are crucial in providing businesses with the broad insights necessary for informed decision-making and strategic planning. As data continues to grow in volume and variety, the ability to effectively aggregate and analyze this information will be a critical success factor for businesses across industries.

Commonly Asked Questions by Data Professionals

- How can businesses ensure they are using ethical practices with data aggregator data sets?

- Businesses should adhere to ethical guidelines and legal standards, ensuring transparency in how data is collected, used, and shared.

- What are the best tools for analyzing data aggregator data sets?

- Advanced analytics platforms that support big data processing, AI, and machine learning are ideal for extracting insights from large, diverse data sets.

- Can small businesses benefit from data aggregator data sets?

- Yes, smaller businesses can leverage these data sets via cloud-based services that offer scalable access to aggregated data without the need for extensive infrastructure.

- What are the challenges in maintaining the relevance of data aggregator data sets?

- Keeping data up-to-date and relevant requires continuous monitoring and updating as source information changes and evolves.

- How do changes in technology affect data aggregation practices?

- Technological advancements often lead to more efficient data collection and processing methods but also require ongoing adaptation and investment in new systems.