Algorithmic Trading Books: Mastering Market Machines

As financial markets evolve with accelerating technological advancements, the demand for a sophisticated grasp of algorithmic trading continues to soar. Books on algorithmic trading serve as indispensable resources, equipping traders and finance professionals with the knowledge to navigate and harness the automated systems that are increasingly predominant in global stock exchanges. These books delve into the core of trading algorithms, offering detailed insights into the strategies, technological innovations, and mathematical frameworks essential for success in today’s automated trading landscape.

Why Invest Time in Reading Algorithmic Trading Books?

Expand Your Market Knowledge

Reading an algorithmic trading book provides an in-depth look into the intricate world of market strategies, data analysis, and statistical models. These books empower readers with the knowledge to not only understand but also leverage the algorithms that perform millions of trades with precision and speed.

Enhance Strategy Development

These publications are vital for anyone looking to craft and refine robust trading strategies. They guide readers through the process of developing sophisticated algorithms that can effectively execute trades, manage risks, and adapt to new market conditions.

Stay Updated on Technological Advances

Algorithmic trading books often include cutting-edge research on the latest technological breakthroughs, such as machine learning and artificial intelligence. They help readers stay current with the technological trends shaping the future of trading.

Characteristics of Exceptional Algorithmic Trading Books

Rich, Practical Content

The most effective algorithmic trading books transcend theoretical discussions, offering actionable advice and real-world examples. They break down complex concepts into digestible information, suitable for both beginners and experienced professionals.

Authored by Industry Leaders

The credibility of an algorithmic trading book is greatly enhanced when authored by seasoned traders or scholars with proven expertise. These authors bring real-world experiences and empirical knowledge, providing a practical perspective on applying trading theories.

Coverage of Cutting-Edge Techniques

A standout book includes comprehensive coverage of advanced trading techniques and the latest technological innovations. It should offer insights that can be applied immediately and adapted to evolving market scenarios.

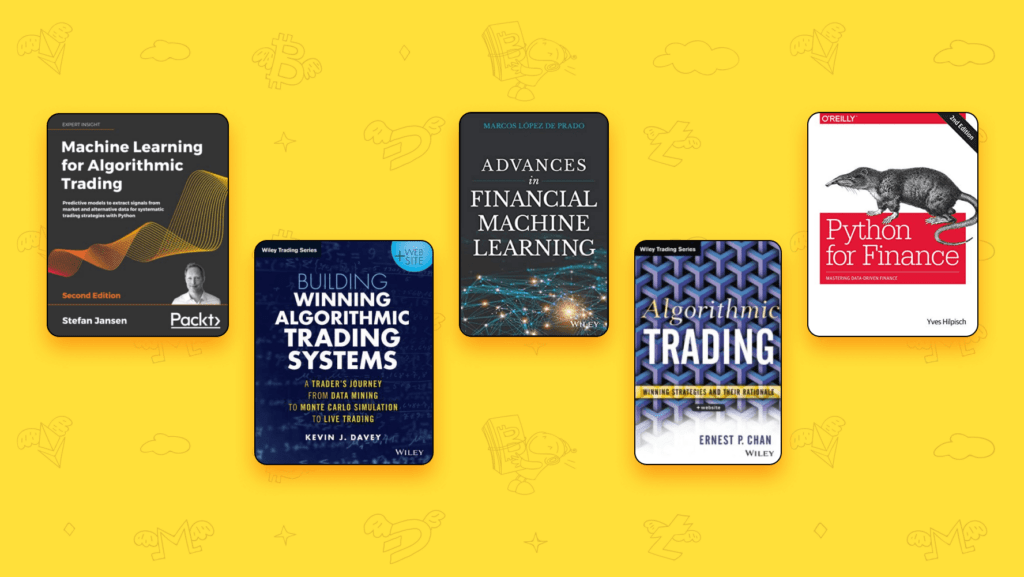

Top Recommended Algorithmic Trading Books

“Algorithmic Trading: Winning Strategies and Their Rationale” by Ernest P. Chan

Highly regarded for its straightforward explanation of complex trading strategies, this book is a staple in the libraries of many trading professionals. It not only explains the theory but also assists in the practical implementation of strategies.

“High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems” by Irene Aldridge

This book provides a thorough exploration of high-frequency trading, covering both the essential theories and their practical applications, making it ideal for traders who operate on both small and large scales.

“The Science of Algorithmic Trading and Portfolio Management” by Robert Kissell

Offering a rigorous scientific approach to the market, this book covers a comprehensive range of topics from the development of trading algorithms to the nuances of trade execution.

Maximizing the Value from Algorithmic Trading Books

Practice as You Learn

While these books lay a solid theoretical foundation, integrating hands-on practice through simulation trading platforms can significantly enhance one’s understanding and skills.

Engage with the Trading Community

Participating in online forums and trading communities can provide practical insights and foster a deeper understanding of the strategies discussed in books.

Commit to Ongoing Learning

Given the rapid pace of technological and methodological advancements in trading, continuous learning is crucial. Staying updated with the latest books and resources ensures that one remains competitive and informed.

Conclusion

Algorithmic trading books are vital tools for mastering the mechanics of modern financial markets. They equip both novices and seasoned traders with the necessary skills and knowledge to design, test, and implement powerful trading algorithms. As the market evolves, these books remain invaluable guides in the pursuit of trading excellence.

Frequently Asked Questions About Algorithmic Trading

Is algorithmic trading still profitable?

Yes, algorithmic trading remains highly profitable for those who can effectively leverage technology and quantitative analysis. This trading approach benefits from the ability to process large volumes of data and execute trades at speeds and accuracies far superior to human traders. However, profitability depends on the quality of the algorithms, the infrastructure supporting them, and the strategy’s alignment with market conditions.

What is the best way to learn algorithmic trading?

The best way to learn algorithmic trading is through a combination of theoretical study and practical experience. Starting with educational books and online courses can provide a solid theoretical foundation. Simultaneously, practical application through simulation software or paper trading allows for experience without financial risk. Networking with experienced traders and participating in relevant forums can also provide insights and real-world advice.

Which algorithm is best for trading?

The best algorithm for trading depends on the trader’s specific goals, risk tolerance, and the market conditions. Commonly used algorithms include mean reversion strategies, momentum algorithms, and statistical arbitrage strategies. Each type has its strengths and is best suited to particular market environments. Continuous testing and adaptation are necessary to determine the most effective algorithm for any given situation.

Can I do algorithmic trading on my own?

Yes, individual traders can engage in algorithmic trading on their own, but it requires a solid foundation in both trading principles and technical skills like programming. Many platforms offer tools and frameworks that simplify the process of developing and deploying trading algorithms. However, individual traders must invest time in learning these tools and continuously monitoring and tweaking their algorithms to maintain effectiveness