Behavior functions refer to the purposes or reasons behind why individuals engage in specific behaviors. In the field of behavior analysis, understanding these functions is crucial for developing effective interventions and promoting positive behavior change.

By identifying the underlying reasons for behaviors, practitioners can tailor their approaches to address the root causes rather than simply reacting to the behavior itself.

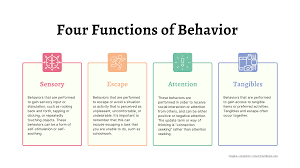

Overview of the 4 Behavior Functions

Behavior analysts generally recognize four primary functions of behavior:

- Sensory stimulation

- Escape/Avoidance

- Attention

- Access to tangibles

Each of these functions serves a specific purpose for the individual exhibiting the behavior, and understanding them is key to effective behavior management.

Sensory Stimulation

Definition and examples

Sensory stimulation refers to behaviors that provide some form of internal sensory feedback or pleasure. Examples include:

- Rocking back and forth

- Hand flapping

- Humming or making repetitive sounds

Identification methods

To identify sensory-seeking behaviors, observers should look for:

- Behaviors that occur across different settings

- Behaviors that persist even when the individual is alone

- Facial expressions indicating enjoyment or relaxation during the behavior

Intervention strategies

Interventions for sensory-seeking behaviors may include:

- Providing alternative sensory activities

- Incorporating sensory breaks into routines

- Using sensory integration therapies

Escape/Avoidance

Definition and examples

Escape or avoidance behaviors are those that allow an individual to avoid or remove themselves from unpleasant situations. Examples include:

- Tantruming when asked to complete a task

- Leaving the room when facing a difficult situation

- Refusing to participate in non-preferred activities

Identification methods

To identify escape/avoidance behaviors, look for:

- Behaviors that occur consistently in specific situations

- Reduction or cessation of the behavior when demands are removed

- Increase in the behavior when demands are presented

Intervention strategies

Strategies for addressing escape/avoidance behaviors may include:

- Gradually increasing task demands

- Providing choices within tasks

- Teaching appropriate communication for breaks or help

Attention

Definition and examples

Attention-seeking behaviors are those that elicit a response from others. Examples include:

- Calling out in class

- Engaging in disruptive behavior

- Excessive complaining or whining

Identification methods

To identify attention-seeking behaviors, observe for:

- Behaviors that increase when others are present

- Behaviors that stop or decrease when attention is provided

- Repetition of the behavior until attention is received

Intervention strategies

Interventions for attention-seeking behaviors might include:

- Providing positive attention for appropriate behaviors

- Teaching appropriate ways to seek attention

- Implementing planned ignoring for inappropriate attention-seeking

Access to Tangibles

Definition and examples

Behaviors aimed at accessing tangibles are those that result in obtaining desired items or activities. Examples include:

- Grabbing toys from others

- Throwing tantrums to get preferred items

- Negotiating for extra screen time

Identification methods

To identify behaviors aimed at accessing tangibles, look for:

- Behaviors that occur when preferred items are visible but not accessible

- Cessation of the behavior when the item is provided

- Increase in the behavior when access to items is restricted

Intervention strategies

Strategies for addressing these behaviors may include:

- Teaching appropriate requesting skills

- Implementing token economies or reward systems

- Providing scheduled access to preferred items

Assessing Behavior Functions

Functional Behavior Assessment (FBA)

FBA is a systematic process used to identify the functions of behavior, involving:

- Gathering information about the behavior

- Identifying antecedents and consequences

- Formulating hypotheses about the behavior’s function

Direct observation techniques

These include:

- ABC (Antecedent-Behavior-Consequence) data collection

- Frequency counts

- Duration recording

Indirect assessment methods

These may involve:

- Interviews with caregivers or teachers

- Behavior rating scales

- Self-report questionnaires

Multiple Functions of Behavior

It’s important to recognize that behaviors can serve multiple functions simultaneously or shift functions over time. Understanding complex behaviors requires:

- Comprehensive assessment

- Consideration of contextual factors

- Ongoing monitoring and analysis

Importance of Identifying Behavior Functions

Accurately identifying behavior functions is crucial for:

- Tailoring interventions to address the specific needs of the individual

- Improving the effectiveness of behavior change strategies

- Promoting long-term positive behavior change

Common Misconceptions

Some common misconceptions in understanding behavior functions include:

- Assuming all behaviors have a single, clear function

- Overlooking the impact of environmental factors on behavior

- Misinterpreting the function based on personal biases or assumptions

Applying Function-Based Interventions

Developing effective interventions based on behavior functions involves:

- Creating comprehensive behavior intervention plans

- Implementing strategies that directly address the identified function(s)

- Continuously monitoring progress and adjusting interventions as needed

Challenges in Determining Behavior Functions

Challenges in identifying behavior functions may include:

- Ambiguous behaviors that don’t clearly align with a single function

- Rapidly changing functions depending on context or environment

- Cultural and contextual considerations that impact behavior interpretation

The Role of Behavior Functions in Different Settings

Understanding behavior functions is crucial across various settings:

- In educational environments, it helps teachers address challenging behaviors effectively

- In clinical settings, it guides therapists in developing targeted treatment plans

- In home and family contexts, it assists parents in managing and shaping their children’s behaviors

Extract Alpha and Behavioral Analysis in Finance

Extract Alpha datasets and signals are used by hedge funds and asset management firms managing more than $1.5 trillion in assets in the U.S., EMEA, and the Asia Pacific. We work with quants, data specialists, and asset managers across the financial services industry.

While Extract Alpha primarily focuses on financial data analysis, the concept of behavior functions can be applied to understanding investor and market behaviors in finance. Some potential applications include:

- Analyzing the functions of investor behaviors in different market conditions

- Identifying the underlying motivations for specific trading patterns

- Developing strategies to address potentially harmful financial behaviors

- Applying behavior function analysis to predict market trends based on collective investor behaviors

Understanding the functions of financial behaviors can provide valuable insights for investment strategies, risk management, and market analysis. By applying principles from behavioral finance and incorporating behavior function analysis, financial professionals can gain a deeper understanding of market dynamics and individual investor decision-making processes.

Conclusion

Understanding the four behavior functions – sensory stimulation, escape/avoidance, attention, and access to tangibles – is fundamental to effective behavior analysis and intervention. By accurately identifying the reasons behind behaviors, practitioners can develop targeted, function-based strategies that address the root causes rather than just the symptoms.

The process of determining behavior functions requires careful observation, systematic assessment, and an understanding of the complexities of human behavior. It’s important to recognize that behaviors can serve multiple functions and that these functions may change over time or across different contexts.

By applying knowledge of behavior functions, professionals in various fields – from education and healthcare to finance and beyond – can develop more effective strategies for behavior change, improve outcomes, and promote positive development. As our understanding of behavior functions continues to evolve, so too will our ability to create more nuanced and effective interventions across a wide range of disciplines and settings.

FAQ: Understanding Behavior

What are the 4 explanations of behavior?

The four explanations of behavior typically refer to the different perspectives from which behavior can be understood:

- Biological Explanation: Behavior is explained through biological factors like genetics, brain chemistry, and neurophysiology.

- Psychodynamic Explanation: Focuses on unconscious drives and early childhood experiences as determinants of behavior.

- Behavioral Explanation: Behavior is explained as a result of learning and conditioning, including reinforcement and punishment.

- Cognitive Explanation: Behavior is influenced by thoughts, beliefs, and perceptions, emphasizing the role of internal mental processes.

What are the four types of behaviors that can be measured?

The four types of behaviors that can be measured include:

- Frequency: How often a behavior occurs within a specific time period.

- Duration: The length of time a behavior lasts during an observation period.

- Intensity: The strength or force with which a behavior is performed.

- Latency: The time it takes for a behavior to begin after a specific event or stimulus.

What are the four basic behavioral types?

The four basic behavioral types are often described in behavioral psychology or personality assessments as:

- Dominant: Individuals who are assertive, decisive, and often take charge in situations.

- Influential: People who are sociable, outgoing, and enjoy engaging with others.

- Steady: Those who are calm, dependable, and prefer consistency and cooperation.

- Conscientious: Individuals who are detail-oriented, analytical, and prefer structure and organization.

What are the 4 domains of behavior?

The four domains of behavior, particularly in the context of behavior analysis, are:

- Social Behavior: Interactions and communication with others, including cooperation, conflict, and social norms.

- Academic Behavior: Behaviors related to learning, such as attention, task completion, and study habits.

- Adaptive Behavior: Skills necessary for daily living, including self-care, decision-making, and problem-solving.

- Challenging Behavior: Actions that are disruptive or harmful, such as aggression, non-compliance, or self-injury.

What are the 4 functions of behavior?

The four functions of behavior describe the reasons why a behavior might occur:

- Escape/Avoidance: The behavior allows the individual to escape from or avoid an undesirable situation or task.

- Attention: The behavior seeks to gain attention from others, such as peers, teachers, or caregivers.

- Access to Tangibles: The behavior is performed to obtain a desired item or activity.

- Sensory Stimulation: The behavior provides sensory input or self-reinforcement, often seen in repetitive or self-stimulatory actions.

What are the 4 basic behaviors?

The four basic behaviors, often categorized in psychology or behavioral assessments, are:

- Aggressive: Behavior that is forceful, confrontational, or hostile.

- Passive: Behavior that is submissive, compliant, or avoids confrontation.

- Passive-Aggressive: Behavior that expresses aggression indirectly, often through procrastination or stubbornness.

- Assertive: Behavior that is confident, direct, and respects both personal rights and the rights of others.

What are the 4 characteristics of behavior?

The four characteristics of behavior, particularly in behavior analysis, include:

- Observable: Behavior can be seen or measured objectively.

- Measurable: Behavior can be quantified in terms of frequency, duration, intensity, or latency.

- Repeatable: Behavior can occur multiple times under similar conditions.

- Functional: Behavior serves a specific purpose or function, often related to obtaining a desired outcome or avoiding an undesirable one.