By Vinesh Jha, ExtractAlpha CEO and founder

2024 saw significant growth in ExtractAlpha’s client base, team, and product offerings. We saw the general demand for alternative data grow, and in particular have seen that the market for data and signals with provable alpha remains very strong. Much of the demand for these datasets comes from the quant market, and newly launched funds and pods are often especially keen to take on datasets which can help them generate alpha on day one.

At a high level, what ExtractAlpha aims to do is to help our clients find alpha in alternative datasets. Our internal research team does extensive research on dozens of datasets per year, vets and identifies those which have predictive power for returns or KPIs, and then delivers those datasets to our clients, either in raw form or as stock selection signals. Our product suite now includes 16 different offerings, several with global coverage.

In this brief retrospective I’ll cover the growth in our client base, team, and products, and highlight the performance of our flagship stock selection signals. I’ll end with a look forward to what we’ll be bringing to the market over the course of 2025.

Clients

Our clients are primarily hedge funds, but also include asset managers, asset owners, and partners in the FinTech space. Most of the funds have a quantitative focus and that is where most of our growth in 2024 has come from. We expect that mix to diversify quite a bit in the coming year. Our clients are also global, including funds from the Americas, EMEA, and APAC; although we’re Hong Kong-based, most of our clients are in the US, but we are seeing growth in all regions.

During a recent trip to New York to visit our clients, I heard quite a lot of positive feedback about our offerings. In particular, our clients seemed to appreciate that we make our data easy to access, with good formatting, timestamping, and identifier mappings; that our white papers and other collateral are informative; and that our client success team is very responsive and helpful. Our hope is that we can set up trials to maximize the efficiency of our clients finding (or failing to find!) value in our data, and to be as transparent as possible about what they are likely to find before they get started.

Here are a few recent testimonials:

“We’re impressed with your breadth of data sources, and your commitment to research and adding new signals, sources, and geographies over time.”

“We literally looked at all of your signals. As an asset manager, your focus on new sources of data, and converting it to signals is invaluable.”

“Your data was extremely easy to map to our identifiers. That’s not our usual experience with alt data vendors, so thank you for having such clean data!”

“Vinesh and his team continue to partner and innovate in the space. If there is one person in alternative data that understands how to build products and partnerships, it’s Vinesh Jha.”

Team and significant events

Our global team continues to grow with a presence in Hong Kong, the US, Canada, and Europe, including our Estimize subsidiary. This year, we are very excited to welcome Professor Alan Kwan from the University of Hong Kong as our research advisor.

We attended several events throughout the course of the year and look forward to seeing you at those conferences this coming year. We also received recognition for “best alternative data provider,” and “best data analytics provider” from the Inside Market Data Awards, and the A-Team Data Management Insights Awards.

Products

In 2024 we launched several new and exciting products.

In February we went live with the Japan News Signal. We developed this innovative stock selection signal in partnership with Nikkei and leverages Japanese-language NLP to capture mid-horizon alpha from Japanese news stories.

In November we launched our U.S. Analyst Model. This powerful signal leverages our flagship TrueBeats surprise predictions for EPS, revenues, and other KPIs, as well as other sell side analyst forecasts such as price targets and industry-specific forecasts.

We launched a new integration of the Estimize platform on Interactive Brokers. The new widget, available to all IBKR users, delivers our crowdsourced earnings estimates and also allows those users to input their forecasts directly within the IBKR platform. We also offer this service to other brokers and financial websites.

Finally, we soft-launched our Sell Side Coverage Matrix late last year – more information coming soon, but this is a new way for investors to benchmark their stocks and signals using a dynamic metric of overlapping sell side analyst coverage, as an alternative or supplement to traditional industry groupings.

Performance

The most important thing to our team is that we deliver alpha to our clients, and we’ve continued to do that. We track performance of all of our signals on an ongoing basis and offer full transparency to our users, with realistic yet replicable backtests on universes of liquid names

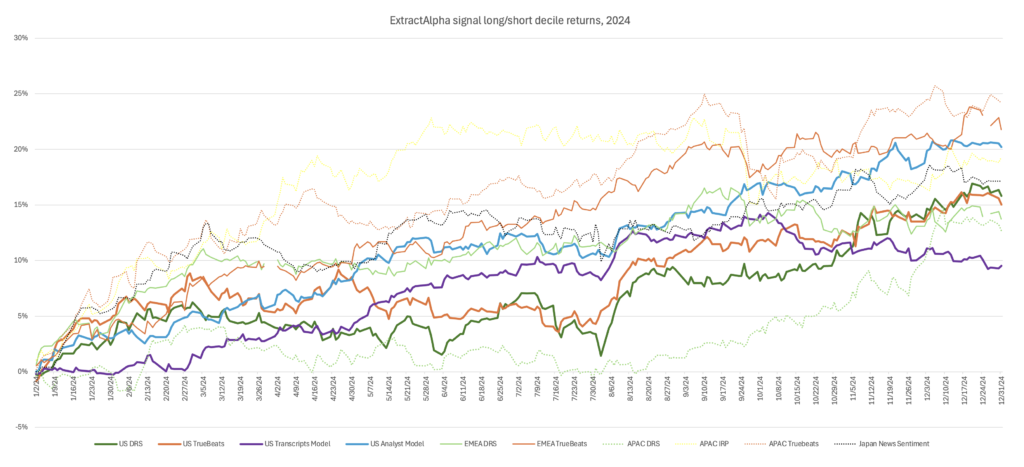

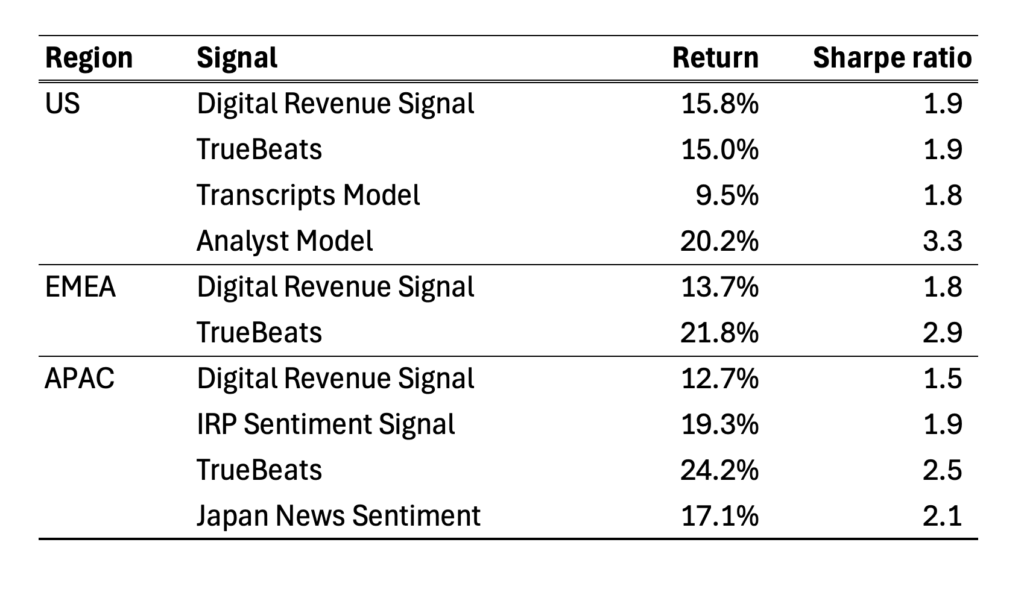

The below chart and table show the performance of our flagship stock selection signals, all of which delivered gross long-short Sharpe ratios in the 1.5 to 3.3 range over 2024.

Our TrueBeats and Estimize datasets also continued to deliver accurate predictions of earnings and revenue surprises, being more accurate than the sell side consensus over 70% of the time every quarter this year.

Looking ahead to 2025

In 2025 we’ll find more ways to help our clients extract alpha. We’ll increase our dataset and signal suite, starting with a global version of our Analyst Model. We’ll release some exciting web-based products for wealth managers, and we’ll continue to research and implement new ways to improve our research infrastructure, methodologies, data delivery, and client success.

We’d like to take this time to thank our clients and partners for a successful year. And if you have any questions or feedback, or would like to learn more about our offerings or trial our datasets, please reach out at any time.

Happy trading!

Vinesh