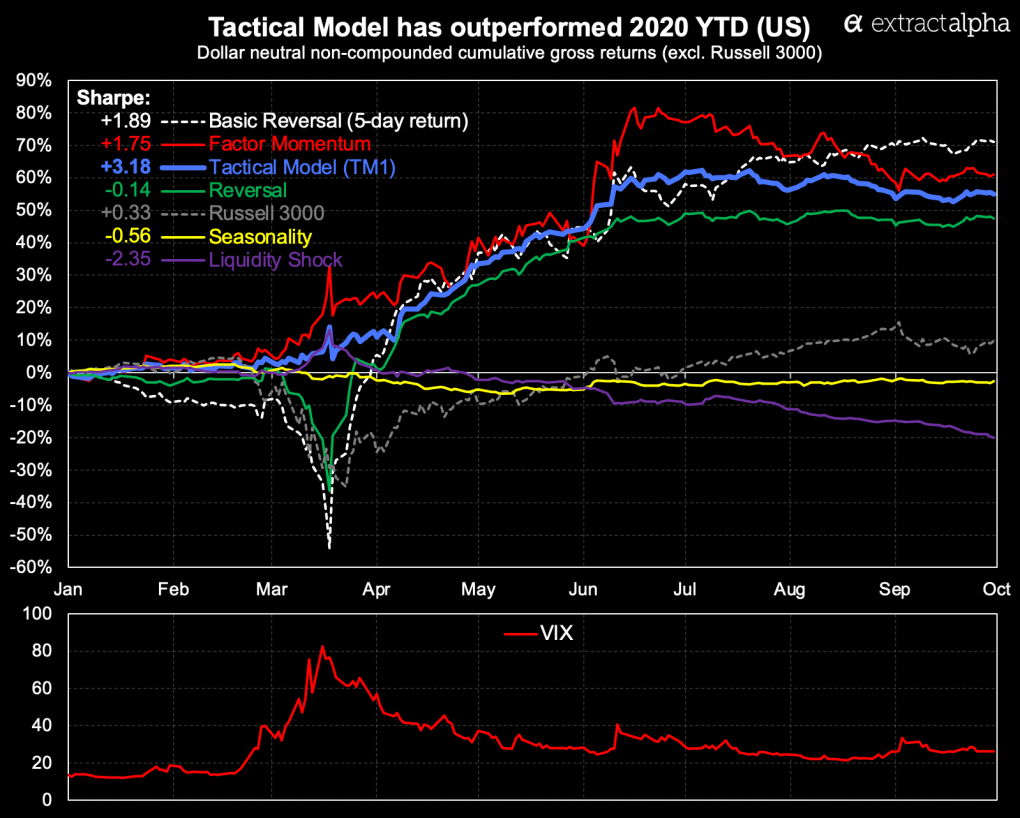

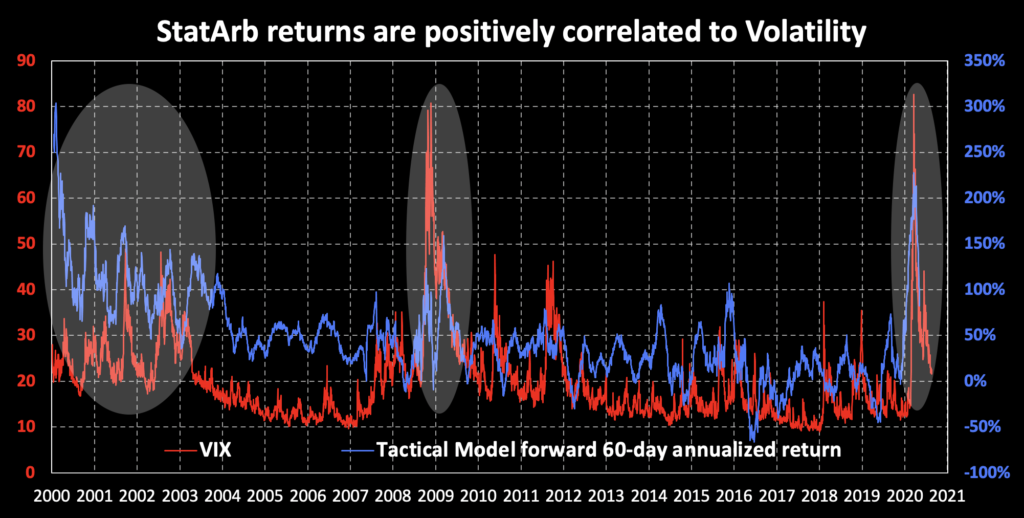

Our proprietary StatArb model – Tactical Model (TM1) – has outperformed 2020 year-to-date through the COVID-19 crisis and its accompanying volatility. Motivated by this strong performance, in this research note we revisit our earlier research from 2016 on how short-horizon, StatArb style alpha factors perform amidst volatility and opportunity (cross-sectional standard deviation in returns).

Research: StatArb, Volatility, and Opportunity – revisited

Tactical Model (TM1) is constructed by combining 4 subcomponents based on recent profitability (please contact us for details):

- Reversal: a stock’s idiosyncratic movements – returns after isolating from industry, risk factors, and liquidity – should mean revert over time

- Factor Momentum: common risk factor components of a stock’s returns tend to trend as investors shift factor/style exposures together

- Seasonality: stocks that historically outperformed in particular periods tend to continue to outperform in subsequent periods

- Liquidity Shock: investors prefer stocks with high liquidity