Our CEO & founder – Vinesh Jha – was recently featured in an article on Risk.net

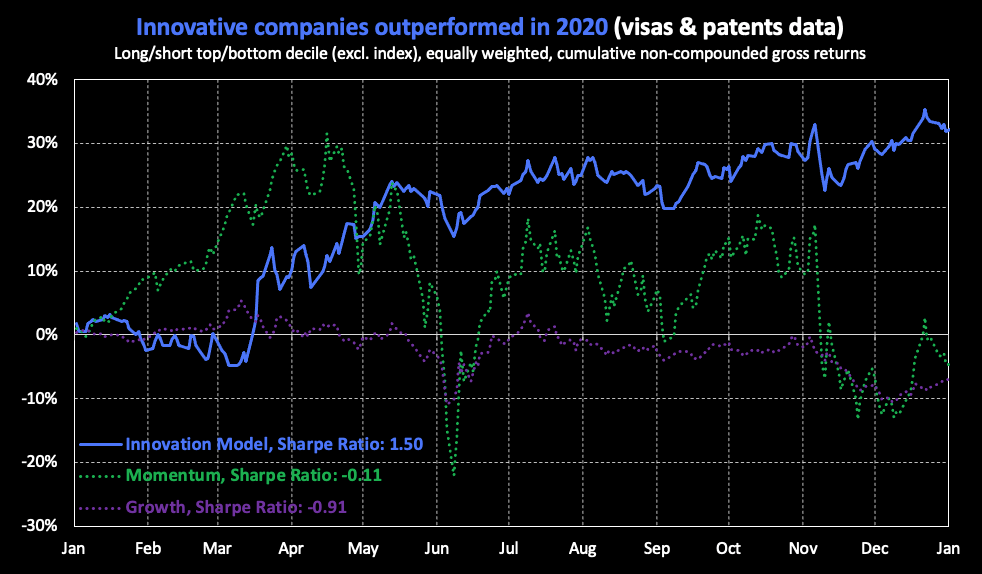

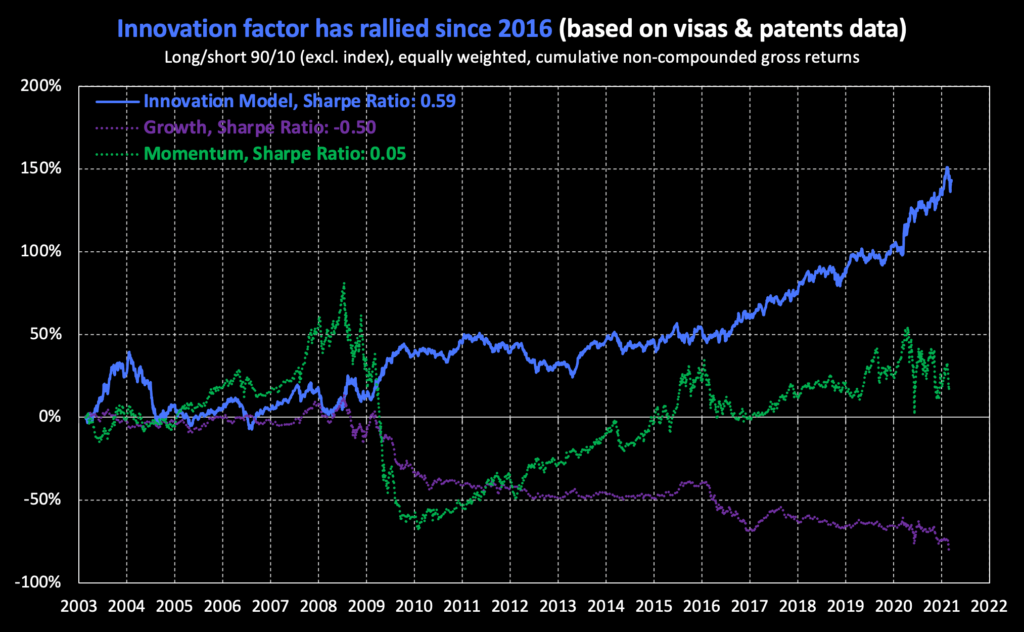

The article examines our Innovation Model (to be released), which has outperformed in 2020, and is constructed using data on foreign worker visas and patents from our ESGEvents Library.

Key takeaways:

This year, and especially around March, a lot of the focus in the market has been on companies that are relying on technology or are more adapted to operating online.

Both top and bottom decile (most and least innovative stocks) based on our model plunged with the market in late February and March. However, the most innovative stocks fell much less than the least innovative stocks. This divergence in returns is captured in our dollar neutral portfolio (long/short top/bottom decile).

The outperformance of our innovation model is not explained by big tech stocks:

The portfolio is equally weighted in both top and bottom deciles

The Innovation model adjusts for both company size and industry averages in visas and patents data

- The portfolio outperformed during both major moves in March and November

- We’ve seen a trend of more innovative companies and industries outperforming roughly since 2013, with a huge acceleration this year.

- Innovative companies get underpriced: analysts won’t make bullish calls on companies that might amount to nothing. The market cares about predicting earnings because earnings are what investors takes home. Most innovative companies aren’t earnings stories, they’re long-term bets on a technology. The market is afraid of picking winners when the vast majority of innovative firms fail.

- Innovative companies themselves often hide their success: studies have shown innovative companies tend not to report research and development. This is known as the information paradox: a company that discloses information about a technology advance devalues its own work by revealing too much about its secrets.

- R&D expenditure can damage balance sheets: this disappoints investors. Intangible capital expenditure shows up right away as a cost, unlike capital expenditure on plants or machinery that can be spread over several years under accounting rules.