I’ve been studying earnings estimates data for about 23 years now. In that time, the state of the art in quantitative earnings forecasting has evolved. The creation of the Institutional Brokerage Estimates System (I/B/E/S) in the 1970’s – where forecasts from multiple brokers were combined to create a “consensus” – was the first game changer, and consensus estimates remain common in many financial applications.

Then, starting in the 1990’s, academic and practitioner research started to show that consensus forecast errors could be improved upon by looking at exactly who was providing those estimates – by considering their track record, tenure, employer, timeliness, and other features. New analytics firms such as Zacks, DAIS Group, and notably StarMine, built analytics to come up with a better composite forecast of earnings, and therefore, of earnings surprises. I was fortunate to be an early team member at StarMine and designed the original SmartEstimate alongside StarMine’s founder in 1999 and 2000. Other providers such as S&P Global soon followed suit with their own versions.

Few of these methodologies, however, have evolved or improved in the last 15-20 years. All of these existing methods are limited by the range and quality of forecasts made by the underlying analysts. But there are cases when all analysts are similar, and/or analysts do not provide the most significant source of forecast accuracy. These techniques fail to take into account a wide variety of information which can be gleaned from other sources of information on corporate earnings, including time series and cross-sectional effects. The amount of information available has increased, along with the data science tools at our disposal, but these models have remained stagnant. Until now.

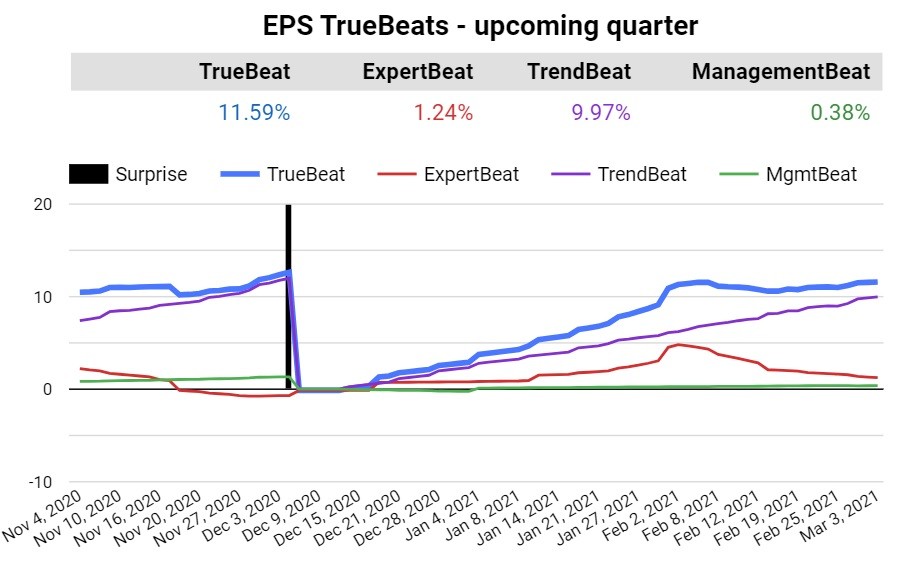

Today I’m pleased to announce ExtractAlpha’s release of the TrueBeat, which extends these earlier ideas to create the new state of the art: a much stronger prediction of upcoming earnings and sales surprises than has come before. TrueBeats incorporates three subcomponent forecasts:

- ExpertBeat: the quality and timeliness of the forecasts made by sell side analysts

- TrendBeat: Historical earnings and revenue trends for the company in question as well as its peers

- ManagementBeat: Variables which capture management behavior, such as management guidance, estimate variance, announcement timing, and company characteristics

TrueBeats dynamically incorporates these subcomponents to create explicit earnings and revenue surprise forecasts, with intelligent look-back periods and weightings. These surprise forecasts can be combined with consensus earnings and revenue estimates to create a superior numerical forecast of EPS and sales.

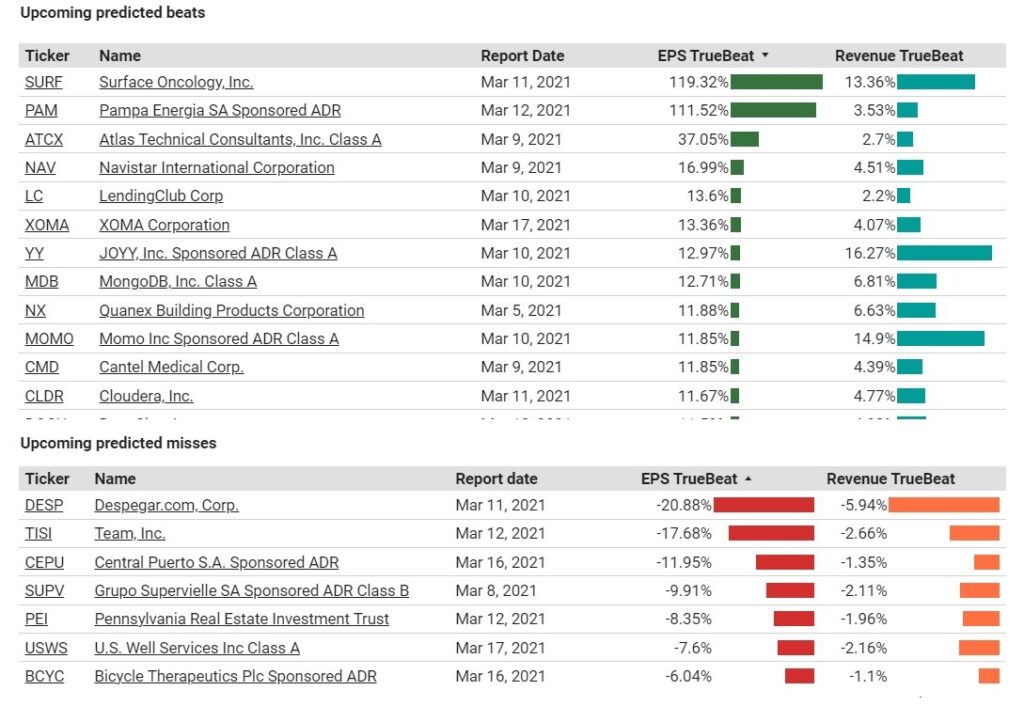

TrueBeats, built on FactSet’s excellent detailed earnings estimates data, accurately predict earnings and sales surprises for thousands of companies every day with an 80% accuracy rate, by combining the above diversified sources of earnings intelligence. Here’s what they look like in practice:

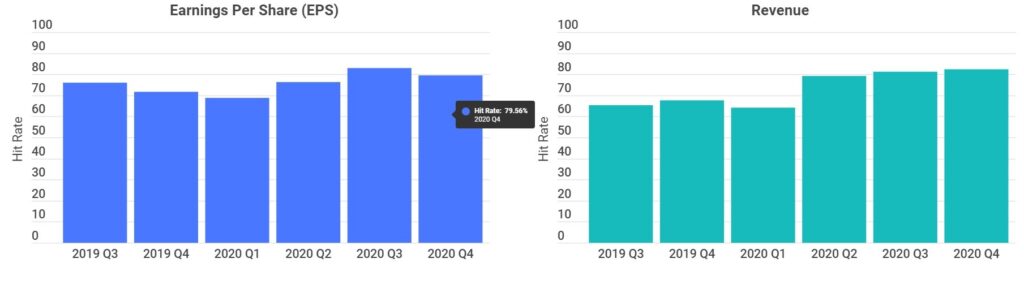

How did TrueBeats do in the last few quarters? You can check out the scorecard here, where you can also see our hits and misses, and download sample data:

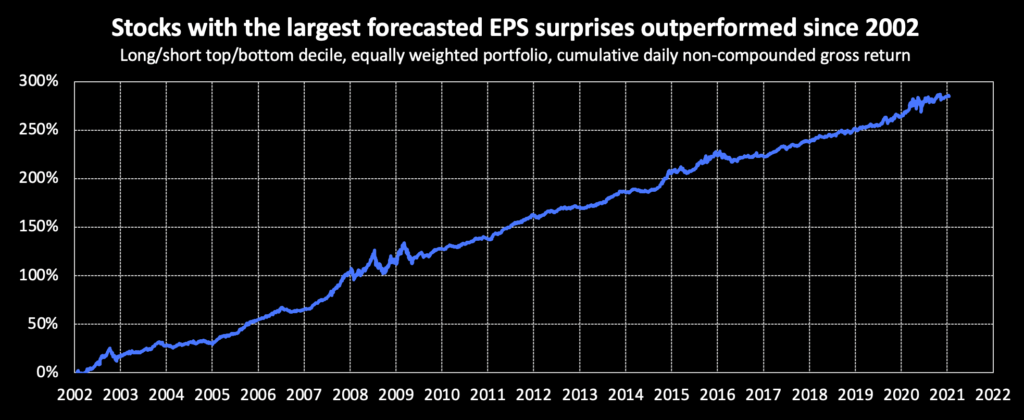

What about using TrueBeats as an alpha factor? Our research team looked into that too. If we form dollar-neutral portfolios which go long the largest TrueBeat values and short the smallest (most negative) ones, and rebalance each day, we see a nice return curve like so:

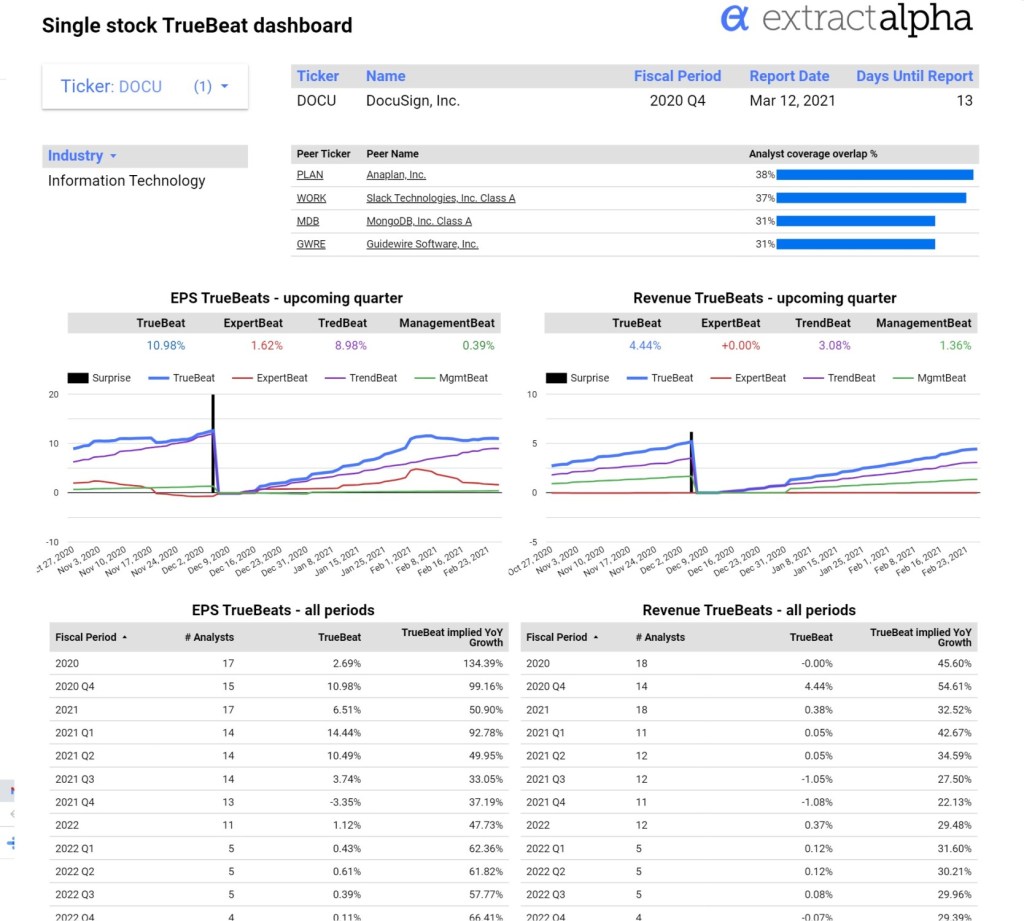

TrueBeats are available as a datafeed and on a new beta dashboard product, where one can see all upcoming expected beats and misses and drill down into the single-stock details:

In summary, TrueBeats can be additive to any investment process which looks to forecast EPS and revenue surprises or to use an innovative sentiment signal in alpha generation.

We are very excited about the launch of the new state of the art in earnings surprise prediction models. Please reach out for further information!