Alternative data Refers to any non-traditional data source that can be used to gain insights into market trends and investment opportunities. In recent years, the use of this type of data has exploded, as investors seek to gain an edge in increasingly competitive markets. But what exactly is this data, and how can it be used?

Here is a short summary on Alternative Data

Alternative data offers unique market insights for investment analysis, but comes with challenges like data quality, privacy, and bias concerns. Its strategic use is key in modern finance.

Lazy to read? This video does a great job explaining what it Alternative Data?

What is Alternative Data?

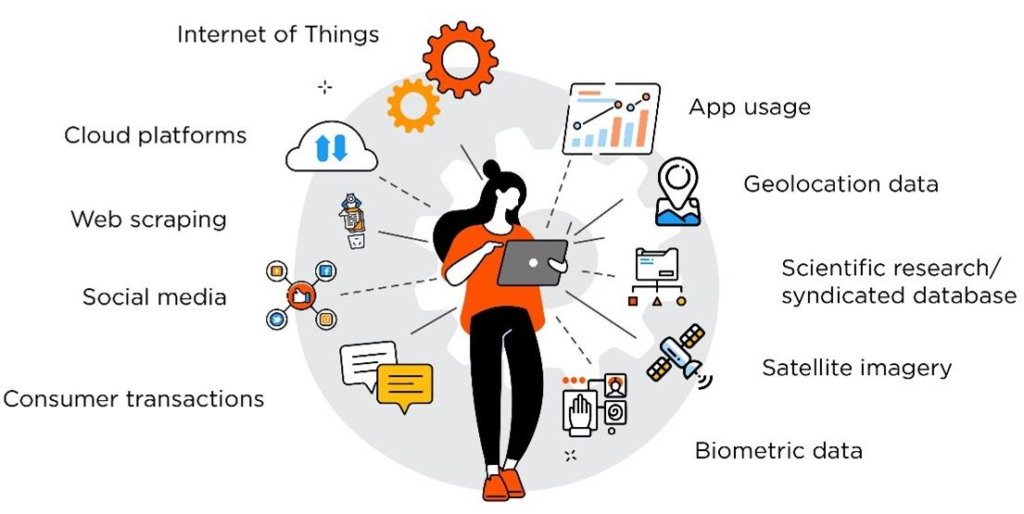

This is defined as any data source that is not traditionally used by investors. This can include:

- Social media posts

- Satellite imagery

- Credit card transactions

- Web traffic data

- Job listings

These data sources can be used to gain insights into a variety of market trends, from consumer behavior to supply chain disruptions.

Different types of alternative data, typical cost and usefulness in investing

Table Format:

- Type of Alternative Data: This column will list various types of alternative data.

- Typical Cost: This will provide an approximate range or description of the cost associated with obtaining this type of data.

- Usefulness in Investing: This column will describe how the data is typically used in investment strategies or decision-making.

Table Content:

| Type of Alternative Data | Typical Cost | Usefulness in Investing |

|---|---|---|

| Social Media Sentiment | Moderate to High | Useful for gauging public sentiment about companies, products, and services. |

| Credit Card Transaction Data | High | Provides insights into consumer spending habits and trends. |

| Satellite Imagery | Very High | Helps in assessing physical changes, like inventory levels at retail stores. |

| Web Traffic and App Usage Data | Moderate | Indicates the popularity and usage trends of online services and apps. |

| E-commerce Transaction Data | High | Offers real-time insights into online sales and consumer behavior. |

| Email Receipts | Moderate to High | Tracks purchasing data and consumer trends. |

| Supply Chain Data | High | Useful for monitoring production levels and logistic efficiency. |

| Geolocation Data | Moderate | Tracks movement trends, useful in retail and transportation sectors. |

| IoT Device Data | High | Provides data on usage patterns and operational efficiencies. |

| Weather Data | Low to Moderate | Can impact commodity prices and affect certain businesses seasonally. |

| News and Publications Analysis | Moderate | Offers insights into market sentiment and potential impact of events. |

| Patent Filings and Intellectual Property Data | Moderate to High | Useful for gauging a company’s innovation and potential growth areas. |

Please note that the costs of alternative data can vary significantly based on the provider, the specificity of the data, and the volume of data purchased. Also, the usefulness of each data type can depend on the specific investing strategy and sector focus. This table is a general guide and may not cover all nuances and details.

Maximizing Potential with Alternative Data in Finance

Enhanced Analytical Depth and Precision

In the dynamic world of finance, alternative data has emerged as a game-changer, offering a richness and accuracy in analysis that traditional financial metrics cannot match. This data delves into a myriad of nuanced indicators, such as customer footfall in stores and online sentiment expressed through reviews and ratings. These insights unlock a deeper understanding of customer loyalty and company performance, aspects often overlooked in conventional financial analysis. By integrating these varied data points, businesses gain a more holistic view of a company’s health and potential, facilitating more informed investment decisions.

Informed Decisions Through Historical Context

Alternative data’s ability to provide historical insights is invaluable for investors and financial institutions. By examining past trends and outcomes, stakeholders can engage in predictive analytics, enabling them to foresee potential future scenarios. This historical perspective empowers investors to make more informed choices, strategically positioning themselves for success while steering clear of potential pitfalls. The predictive power of historical alternative data can be a crucial tool in avoiding investments in businesses on the brink of decline.

Enhancing Investment Outcomes and Strategic Partnerships

The broad spectrum of data points that alternative data encompasses also plays a pivotal role in identifying and forging rewarding business partnerships. By analyzing diverse metrics such as market demographics, consumer behavior, and product success, companies can identify synergies and complementary strengths with potential partners. This strategic approach to partnership selection ensures that collaborations are not only successful but also mutually advantageous, leading to sustainable business growth and market expansion.

Building Stronger Customer Connections

Utilizing alternative data for customer insights transforms how companies interact with and understand their clientele. Analyzing online reviews, web traffic, and audience segmentation equips businesses with a profound understanding of their customer base, including preferences, behaviors, and perceptions. Armed with this knowledge, company leaders can tailor brand strategies and initiatives to enhance customer experiences and foster positive perceptions. This customer-centric approach not only strengthens brand loyalty but also positions companies as attentive and responsive in the eyes of their consumers.

Gaining a Competitive Advantage in the Marketplace

In the fast-paced investment landscape, the real-time insights offered by alternative data provide a critical competitive edge. The fluid nature of stock valuations and market dynamics requires an agile approach to investment decisions. Companies leveraging alternative data can swiftly analyze and respond to market shifts, avoiding the pitfalls of outdated or incomplete information. This proactive stance enables organizations to outmaneuver competitors who rely solely on traditional data sources, ensuring they stay ahead in the ever-evolving market.

Navigating the Challenges of Alternative Data in Finance

Quality and Consistency Concerns

The diverse nature of alternative data presents a challenge in maintaining consistent quality. This data comes from various sources and is applied in numerous ways, which makes standardization and regulation difficult. Without a governing body or standardized rules, alternative data sets can suffer from inaccuracies, potentially leading to significant misjudgments. For instance, undetected fraudulent activities might skew a company’s expenditure data, misleading investors and financial institutions about its actual financial health.

Transparency and Trust Issues

As a relatively new area in finance, alternative data raises questions about transparency and trust. The methodologies used for collecting data, such as tracking GPS and online activities, are often unclear to customers and consumers. This lack of transparency can breach the trust that individuals place in companies, especially if data collection occurs without explicit consent. Businesses must navigate these concerns carefully to avoid harming their customer relationships and reputational damage.

Privacy and Security Risks

The use of alternative data involves handling sensitive information, which brings significant privacy and security concerns. The potential for data breaches or unauthorized disclosure of personal data poses risks not only to individuals but also to the companies handling such data. Furthermore, businesses must adhere to various national and local privacy laws, and failure to comply can result in legal repercussions and a loss of consumer confidence.

Potential for Unintentional Bias

The integration of personal data into financial decision-making processes can inadvertently lead to biased outcomes. When decisions are influenced by demographics such as gender, race, or religion, there’s a risk of unintentional discrimination. This bias can result in the creation of flawed data sets that influence future decisions negatively, potentially harming consumers and reinforcing existing societal disparities.

Risk of Data Manipulation

With the public availability of alternative data, there is a risk of manipulation by individuals or organizations seeking to present themselves favorably. Companies might attempt to influence their online image by promoting positive reviews, while individuals could curate their social media presence to appear more creditworthy. Such manipulations can distort the accuracy of alternative data, leading to misguided financial decisions.

Using Alternative Data in Investment Analysis

It can be used in a variety of investment strategies, including:

Quantitative Analysis

Quantitative analysts use mathematical models to analyze large datasets and identify patterns. Alternative data can be used to develop more accurate models and gain a deeper understanding of market trends.

Fundamental Analysis

Fundamental analysts use financial data to evaluate the health of a company and make investment decisions. Alternative data can be used to supplement this analysis, providing insights into consumer behavior, supply chain disruptions, and other factors that can affect a company’s performance.

Risk Management

Can also be used to manage risk. By monitoring alternative data sources, investors can identify potential risks before they become major issues.

Exploring Alternative Data in Finance

Web Traffic and App Usage Analytics

The importance of web traffic and app usage in financial decision-making is highlighted through tools like web and app analytics services. These services, including those offered by SimilarWeb, provide insights into user engagement with applications and websites. Such data is crucial for traders and was exemplified when SimilarWeb, a company providing detailed analytics on a vast number of sites and apps, went public in May 2021, broadening its client base beyond hedge funds.

Social Media Sentiment and Product Reviews

Investment firms are increasingly turning to social media and product reviews to gauge market trends. Providers like Thinknum offer collections of data, such as the Facebook Followers collection, which offers extensive insights into companies’ online presence on platforms like Facebook. Similarly, analysis of product reviews can signal market movements, as was the case with Peloton, where a notable increase in negative reviews preceded a significant drop in share prices.

Utilizing Satellite Imagery

Since 2009, satellite imagery has been a valuable tool for financial analysis. It gained prominence when RS Metrics used satellite data to correlate Walmart’s revenue with its parking lot car counts. Despite challenges posed by e-commerce, satellite imagery remains a key asset for financial firms, aiding in monitoring factors like deforestation or natural disasters that affect supply chains. The growth in satellite technology, spurred by companies like SpaceX and OneWeb, suggests a continuing trend in its usage for financial analysis.

Geolocation Data Insights

Geolocation data, primarily derived from cellular network-based GPS data, offers insights into consumer movement trends. This data type saw a surge in interest, especially in 2020, with companies like SafeGraph experiencing high earnings. Although previously not as prioritized as other data forms like satellite imagery, disruptions in predictable traffic patterns have heightened Wall Street’s interest in geolocation data.

Jet Tracking for Financial Intelligence

Jet tracking has become a novel source of alternative data, with companies like Quandl leading the way. An example of its impact was seen in 2019, when Quandl informed its clients about a private jet carrying Occidental representatives to meet Warren Buffett, a precursor to a significant investment announcement. Since then, services like Quiver Quantitative have emerged, offering free access to corporate private jet tracking, democratizing this form of data for everyday investors.

Optimizing Data Utility in Financial Analysis

Streamlining Data Acquisition and Analysis

In the dynamic realm of financial data analysis, the ability to efficiently process and evaluate data is crucial. Many data intermediaries tend to prioritize volume, offering aggregated data sets with extensive coverage but not necessarily meaningful insights. The critical challenge here lies in discerning the actual value of these data sets. As pointed out by industry expert Ekster, determining the potential worth of a data set is a complex process. It often involves months of research and development, and the true value, in terms of generated alpha, may only become apparent after substantial investment in time and resources.

Innovative Solutions by Neuravest

Neuravest, formerly known as Lucena Research, represents a pioneering force in addressing this issue. The company’s approach involves partnering with select alternative-data providers and rigorously validating data sets before they are used. This validation process is integral to Neuravest’s strategy, ensuring that only high-quality data is utilized in their machine-learning investment models for fund managers.

Data Qualification and Processing

The process at Neuravest begins with what is termed as a ‘data qualification report’. This involves running raw data through a series of checkpoints to assess its relevance and integrity. Following this initial validation, the data undergoes a meticulous preparation phase where it is cleaned, ticker-tagged, and normalized. Only after these steps is a model constructed to develop back-testable investment hypotheses.

Simplifying Data Integration for Clients

The ultimate goal of Neuravest, as highlighted by co-founder and CEO Erez Katz, is to simplify the data integration process for their clients. By identifying data sets that are particularly useful for specific scenarios and presenting them to customers in an easily digestible format, Neuravest aims to eliminate the cumbersome tasks of additional purchases, extensive evaluations, and the need for specialized quantitative analysts and infrastructure. This approach represents a significant stride in making high-quality financial data more accessible and actionable for fund managers and investors alike.

The Enduring Role of Data Analysis in the Evolution of Alternative Data

Integration of Alternative Data in Financial Analysis

The landscape of financial data is continuously evolving, yet the significance of skilled data analysts remains steadfast. In the realm of finance, fundamental firms are increasingly incorporating alternative data to enhance their existing investment strategies. This integration serves to enrich their analysis, providing additional dimensions to their investment hypotheses. Similarly, quantitative analysts (quants) blend this ‘alternative stuff’ with traditional data streams, crafting more comprehensive and robust models. However, it’s crucial to recognize that alternative data acts as a component in the broader analytical framework, complementing rather than replacing traditional data sources.

Diverse Interpretations and the Preservation of Alpha

The notion that widespread availability of a data set leads to diminishing returns, or ‘alpha decay’, is a subject of debate among experts. As Ekster points out, the uniqueness of analysis plays a pivotal role. When multiple analysts or funds are given the same raw data set, the diversity in their analytical approaches can lead to a multitude of profitable strategies. This individualized interpretation ensures that the value of alternative data remains resilient, countering the idea of inevitable alpha decay, even in the face of widespread distribution.

The Importance of Expertise and Innovation

Katz echoes this perspective, underscoring the importance of expertise and innovative thinking in the field. The effective utilization of alternative data in financial markets requires not only strong analytical skills but also a deep understanding of Wall Street dynamics. Analysts must comprehend what drives market movements and how to navigate beyond the common knowledge and perceptions. This combination of analytical acumen and market savvy is essential in leveraging alternative data to its fullest potential, enabling analysts to stay ahead in an ever-changing financial landscape.

FAQ on Alternative Data

What is the difference between alternative data and traditional data?

Traditional data encompasses structured financial reports and economic indicators, while alternative data comes from novel sources like social media or satellite imagery, offering unstructured, innovative insights. A detailed comparison is available at CFA Institute.

What are examples of alternative data sets?

Examples of alternative data sets include social media activity, satellite imagery, credit card transactions, web browsing data, and job postings. These datasets provide unique insights into various aspects such as consumer behavior and economic trends. Deloitte offers an overview of alternative data sources here.

How is alternative data collected?

Alternative data is collected through methods like web scraping, APIs, satellite imagery analysis, and purchasing from data providers. The method depends on the data type and its use. McKinsey & Company provides insights on the collection and use of alternative data here.

These links offer a comprehensive understanding of alternative data, highlighting its definition, distinction from traditional data, examples, and collection methodologies.

Conclusion

This is a powerful tool for investors seeking to gain an edge in competitive markets. By supplementing traditional data sources with non-traditional data sources, investors can gain a deeper understanding of market trends and make more informed investment decisions.