The energy industry is a critical global sector that constantly evolves with advancing technology and shifting market dynamics.

To stay competitive, it is essential to harness the most current and comprehensive data available. Traditional data sources often lag, making real-time, alternative data increasingly vital.

This article explores how alternative data providers like GTCOM and Thasos are revolutionizing the energy industry by offering timely insights that traditional sources cannot, enhancing decision-making and strategic planning.

The image above shows how alternative data sources like GTCOM and Thasos can provide real-time insights into the energy industry, helping investors and business managers stay ahead of the curve. These insights can help identify emerging trends and opportunities that traditional data sources cannot provide.

Why is Alternative Data Important to the Energy Industry?

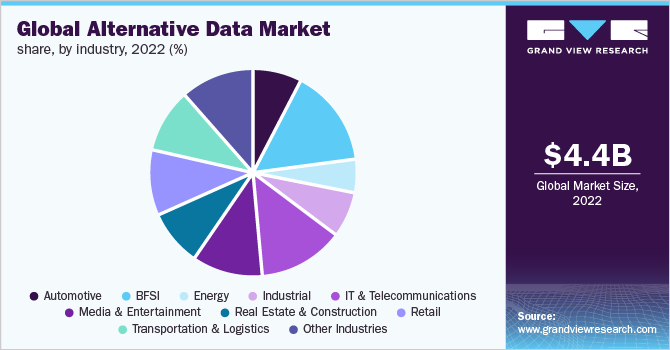

In the rapidly evolving energy industry, alternative data is emerging as a critical resource for businesses seeking to gain a competitive advantage.

This type of data includes information gathered from non-traditional sources that are not usually leveraged in financial analysis, such as social media activity, satellite imagery, and mobile device locations.

The significance of alternative data in the energy sector can be attributed to several key factors:

- Real-Time Insights: Traditional data sources in the energy sector, such as financial statements and market reports, typically have significant time delays. Alternative data, on the other hand, can often be collected and analyzed in real-time, providing immediate insights. This timeliness enables energy companies to respond more quickly to market changes, regulatory updates, or emerging trends.

- Uncovering Hidden Patterns: Alternative data can reveal patterns and correlations that are not visible through traditional data analysis. For instance, analyzing satellite images to monitor oil storage levels or using mobile data to track consumer behavior at gas stations can provide unique insights into supply and demand dynamics that would otherwise be unavailable.

- Enhanced Market Prediction: By integrating alternative data into their analysis, energy businesses can enhance the accuracy of their market predictions. For example, sentiment analysis from social media platforms can help gauge public perception of renewable energy sources, influencing investment and operational decisions.

- Risk Management: The ability to access a broader range of data sources allows companies to better assess and manage risks. Whether it’s monitoring geopolitical developments through news sentiment analysis or tracking weather patterns affecting renewable energy outputs, alternative data provides a more comprehensive view of the potential risks facing the sector.

- Driving Innovation: As the energy industry continues to move towards more sustainable and technologically advanced solutions, alternative data can play a pivotal role in identifying and evaluating new opportunities. For example, data from IoT devices can be used to optimize energy consumption in smart grids, potentially transforming energy distribution and management practices.

The importance of alternative data in the energy industry cannot be overstated. It not only offers the ability to make faster and more informed decisions but also provides a deeper understanding of the complex dynamics that characterize the sector.

As the industry continues to evolve, those who effectively harness the power of alternative data will likely find themselves at the forefront of innovation.

Case Studies of Alternative Data Providers

GTCOM

Global Tone Communication (GTCOM) is an innovative data provider specializing in the analysis of multilingual news sentiment and event tracking. Utilizing advanced natural language processing (NLP) and machine learning technologies, GTCOM extracts valuable insights from vast amounts of global data, making it particularly useful for the energy industry.

Key Features of GTCOM:

- Multilingual Analysis: GTCOM’s platform can process and analyze content across 65 languages, enabling a comprehensive global view. This feature is crucial for multinational energy companies needing to monitor developments in diverse markets.

- News Sentiment Analysis: By evaluating the tone and sentiment of news articles and reports, GTCOM helps companies gauge public opinion and media perception regarding various topics related to the energy sector. This can include reactions to new policies, technological innovations, or environmental concerns.

- Event Tracking: GTCOM’s technology can identify and track significant events that might impact the energy market. This includes geopolitical events, regulatory changes, or major announcements by key players in the industry.

Benefits to the Energy Industry:

- Real-Time Insights: GTCOM provides up-to-the-minute information that helps energy businesses react swiftly to changing circumstances. This can be particularly valuable in a volatile market where conditions can shift rapidly.

- Trend Identification: By analyzing news and events, GTCOM can help companies spot emerging trends before they become mainstream. This early detection can be critical for strategizing investments, especially in renewable energy technologies or new oil and gas fields.

- Geopolitical Impact Analysis: Understanding the geopolitical landscape is essential in the globalized energy market. GTCOM aids companies in navigating complexities by offering insights into how international events may influence market dynamics and regulatory environments.

- Risk Management: Enhanced awareness of global events and public sentiments allows companies to better manage reputational and operational risks. This proactive approach can mitigate potential negative impacts on the company’s value and operations.

In essence, GTCOM serves as a strategic tool for the energy sector, providing actionable insights that help businesses navigate an increasingly complex and interconnected global landscape.

As the energy industry continues to evolve with technological advancements and shifts towards sustainable practices, the insights provided by GTCOM will become even more vital in shaping strategic decisions and maintaining a competitive edge.

Thasos

Thasos is an alternative data provider that leverages mobile phone location data to deliver actionable insights, particularly useful for industries including energy. Since 2015, Thasos has transformed anonymized location data from mobile devices into valuable information that helps investors and business managers make informed decisions.

Key Features of Thasos:

- Data Streams: Thasos offers various specialized data streams that cater to different sector needs:

- MallStreams: Provides insights into consumer foot traffic in shopping malls, useful for analyzing retail energy consumption and trends.

- ConsumerStreams: Delivers data on consumer behavior at various businesses such as gas stations, restaurants, and supermarkets, offering a granular view of consumer energy usage and preferences.

- IndustrialStreams: Focuses on activity across various industries, including energy, providing insights into operations, logistics, and workforce trends.

- Data Transformation: Thasos excels at converting raw location data into intelligible, organized formats that businesses can immediately utilize. This process includes ensuring data privacy and compliance with regulations.

Benefits to the Energy Industry:

- Operational Insights: Thasos can track and analyze the movement and congregation of people within and around energy facilities or events. This information is crucial for managing operational efficiencies, such as adjusting energy production based on expected demand.

- Market Analysis: By examining foot traffic patterns, Thasos helps energy companies understand market dynamics in real-time. For instance, increased consumer presence at electric vehicle charging stations can signal a shift in market demand.

- Strategic Planning: Insights from IndustrialStreams allow energy companies to monitor competitor activities and broader industry movements, aiding in strategic decision-making.

- Risk Management: Understanding patterns and trends in consumer and industrial behavior can help predict and mitigate risks associated with market shifts, natural disasters, or economic downturns.

Thasos’s innovative use of mobile location data provides the energy sector with a nuanced understanding of consumer and industrial behaviors that traditional datasets may overlook.

This level of detail and timeliness of information offers energy companies a competitive edge in a fast-paced and ever-evolving industry landscape.

By integrating Thasos data, energy companies can enhance their operational strategies, adapt to consumer needs more swiftly, and forecast future trends with greater accuracy.

Impact and Utility of GTCOM and Thasos Insights

The innovative data solutions provided by GTCOM and Thasos have profound impacts on the energy industry, enabling companies to navigate complex market dynamics with enhanced precision and foresight.

The utility of insights from these alternative data providers can be seen across various facets of the energy sector, from strategy development to operational efficiency and risk management.

Impact and Utility of GTCOM Insights:

- Strategic Decision-Making: GTCOM’s real-time news sentiment and event tracking empowers energy companies to make informed strategic decisions. By understanding the global sentiment around energy trends and geopolitical events, companies can anticipate market shifts and adjust their strategies accordingly.

- Enhanced Market Understanding: The multilingual capabilities of GTCOM allow for a broader and more inclusive analysis of global market conditions. This is especially useful for multinational energy corporations that operate across different regulatory and cultural landscapes.

- Risk Mitigation: By providing early warnings about geopolitical tensions or environmental policies, GTCOM helps energy companies proactively address potential risks before they escalate. This capability is crucial in avoiding or minimizing disruptions to supply chains and operations.

Impact and Utility of Thasos Insights:

- Consumer Behavior Analysis: Through ConsumerStreams and MallStreams, Thasos provides detailed insights into consumer behavior, which can guide energy companies in tailoring their services to meet changing consumer demands, such as the increased interest in renewable energy sources.

- Operational Optimization: IndustrialStreams data enables energy companies to monitor industry-specific activities, helping them optimize operations based on actual industrial and consumer patterns. For instance, understanding peak times for energy usage can help in managing load distribution more effectively.

- Competitive Advantage: Access to real-time, granular data allows energy companies to stay one step ahead of their competitors. By analyzing trends and movements within the industry, companies can seize opportunities faster and more efficiently than those relying solely on traditional data sources.

Overall Utility:

Both GTCOM and Thasos offer distinct but complementary insights that, when combined, provide a comprehensive view of both the macro and micro aspects of the energy market. GTCOM’s global news sentiment analysis and Thasos’s detailed behavioral data together enable energy companies to:

- Adapt Quickly: Adapt strategies in real-time based on current data and trends.

- Forecast with Accuracy: Better predict future market movements and consumer trends.

- Enhance Customer Engagement: Tailor products and services to meet evolving consumer needs.

- Maintain Compliance: Stay updated with regulatory changes and ensure compliance.

The insights provided by GTCOM and Thasos are instrumental for energy companies looking to thrive in a competitive, fast-paced, and ever-evolving industry. These data sources equip businesses with the tools to not only respond to current conditions but also strategically plan for future challenges and opportunities in the energy sector.

Alternative data is becoming increasingly important to the energy industry. Providers like GTCOM and Thasos provide investors and business managers with real-time insights that traditional data sources cannot provide. As the energy industry continues to evolve, alternative data sources will become even more important for making informed decisions.

Conclusion

The adoption of alternative data is crucial for energy companies striving to navigate the complex and evolving market landscape. Providers like GTCOM and Thasos deliver invaluable insights that surpass traditional data, enabling firms to make proactive, informed decisions.

As the energy industry continues to embrace rapid technological changes and shifting consumer preferences, the significance of alternative data will only grow.

By leveraging the real-time, comprehensive analytics from these providers, energy businesses can enhance strategic planning, operational efficiency, and competitive edge, paving the way for a more dynamic and data-driven future in the energy sector.