The Alternative Data for Retail industry is one of the most competitive industries in the world. To remain competitive, retailers must be able to anticipate trends and make data-driven decisions. Traditional sources of retail data such as sales reports and market research are no longer enough to keep up with the competition. This is where alternative data comes in. Alternative data refers to non-traditional sources of data that can be used to gain insights into consumer behavior and market trends.

What is Alternative Data?

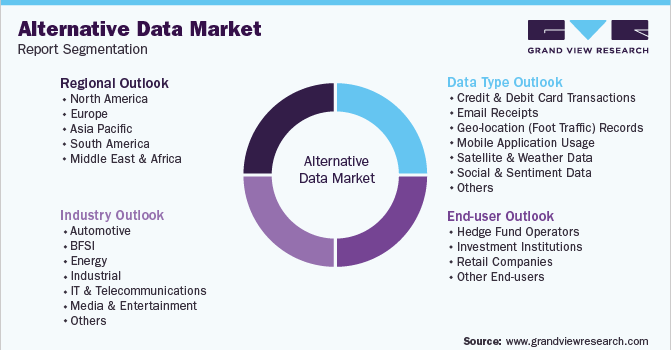

Alternative data is data that is not typically used by analysts in their traditional models. This data comes from a variety of sources, such as social media, mobile phone traffic, satellite imagery, and credit card transactions. Alternative data providers collect, analyze, and package this data for use by investors, analysts, and businesses.

Why is Alternative Data Important to the Retail Industry?

Alternative data is important to the retail industry because it provides a more complete picture of consumer behavior and market trends. Traditional sources of data such as sales reports and market research only provide a snapshot of consumer behavior at a specific point in time. Alternative data provides real-time insights into consumer behavior, which can be used to make data-driven decisions.

Other Potential Sources of Alternative Data for Retail

Apart from Advan and Dataminr, there are other potential sources of alternative data that can be useful to retailers. These sources include:

1. Google Trends

Google Trends is a tool that allows retailers to see what people are searching for online. Retailers can use this data to identify trending products and plan their inventory accordingly. They can also use this data to identify geographic areas where their products are in high demand.

2. Yelp

Yelp is a platform where consumers can leave reviews about businesses. Retailers can use Yelp data to monitor customer feedback and improve their products and services. They can also use Yelp data to identify areas where their products are in high demand.

3. Facebook

Facebook is a social media platform where retailers can monitor consumer sentiment around their brand. They can also use Facebook data to identify trending products and plan their inventory accordingly. They can also use Facebook data to identify geographic areas where their products are in high demand.

4. Instagram

Instagram is another social media platform that can be useful to retailers. They can use Instagram data to identify trending products and plan their inventory accordingly. They can also use Instagram data to identify geographic areas where their products are in high demand.

How Retailers Can Use Alternative Data

Retailers can use alternative data in a variety of ways. Here are some examples:

1. Forecasting Sales

Alternative data can be used to forecast sales. For example, retailers can use weather data to predict foot traffic in their stores. They can also use social media data to predict demand for certain products.

2. Identifying Trends

Retailers can use alternative data to identify trends. For example, they can use social media data to identify trending products and plan their inventory accordingly.

3. Improving Customer Experience

Retailers can use alternative data to improve customer experience. For example, they can use Yelp data to monitor customer feedback and improve their products and services.

4. Identifying Areas of High Demand

Retailers can use alternative data to identify areas of high demand. For example, they can use Google Trends data to identify geographic areas where their products are in high demand.

Why Retailers Should Use Alternative Data

Retailers should use alternative data because it provides a more complete picture of consumer behavior and market trends. Traditional sources of data such as sales reports and market research only provide a snapshot of consumer behavior at a specific point in time. Alternative data provides real-time insights into consumer behavior, which can be used to make data-driven decisions.

Advan

One potential source of alternative data for the retail industry is Advan. Advan collects mobile phone traffic data and weather data dating back to 1998. They cover 1,600 tickers across several sectors. This data can be used to gain insights into consumer behavior, such as foot traffic in stores during different weather patterns.

Dataminr

Another potential source of alternative data for the retail industry is Dataminr. Dataminr provides social sentiment and news analysis based on Twitter data. This can be used to gain insights into consumer behavior and market trends. For example, retailers can use this data to anticipate trends in fashion or to monitor consumer sentiment around their brand.

Conclusion

Alternative data is becoming increasingly important to the retail industry. By using alternative data sources such as Advan, Dataminr, Google Trends, Yelp, Facebook, and Instagram, retailers can gain real-time insights into consumer behavior and market trends. This can help retailers to remain competitive and make data-driven decisions.