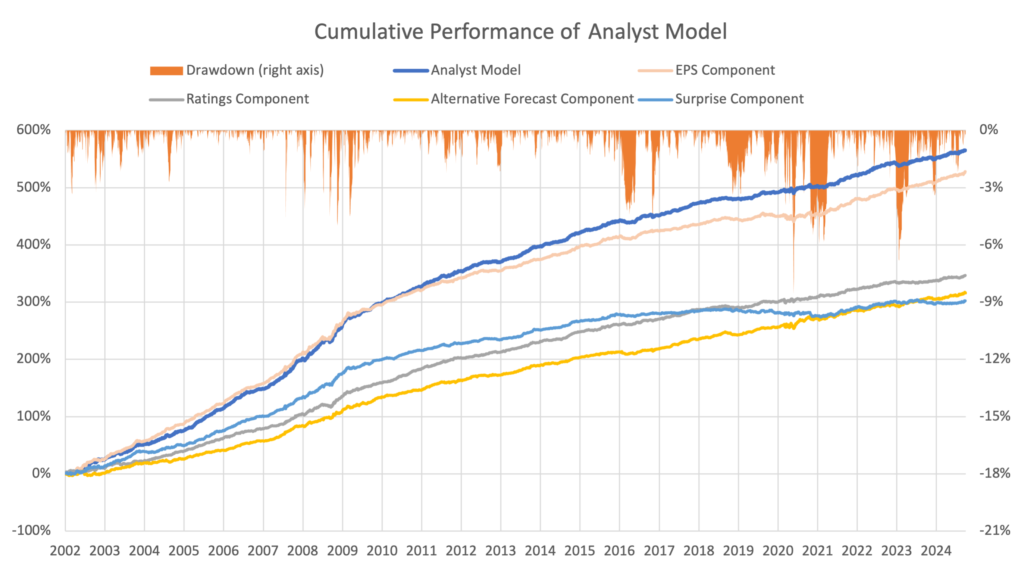

Analyst Model

The ExtractAlpha Analyst Model offers institutional investors a sophisticated stock selection tool, integrating advanced surprise predictions and analyst revisions across critical financial metrics.

Driven by our proprietary TrueBeats methodology, this model consistently outperforms traditional consensus forecasts.

Key Features

- TrueBeats Surprise Prediction: Accurately predicts surprises across metrics like EPS, sales, cash flow, and industry-specific KPIs, outperforming standard models by focusing on the most accurate sell side analysts, trends in surprises, and earnings management features

- Analyst Revisions: Incorporates broker-specific changes to analyst estimates, enhancing the model’s precision using detailed estimates data across all forecast items

- Analyst ratings: Leverages analyst recommendations and target prices for a nuanced predictive advantage

- Broad Sector Coverage: The model encompasses over 4,000 securities in EPS and sales metrics, with 1,000+ securities covered by industry-specific KPIs. This wide coverage supports diverse sector applications for robust portfolio insights.

Applications

This model is a versatile tool for institutional investors, enhancing alpha generation through its precise surprise predictions and analyst revisions across key metrics like EPS, sales, and industry-specific KPIs.

Its applications range from systematic strategies leveraging TrueBeats for earnings forecasts to fundamental investors optimizing sector and factor exposures and identifying trends in KPIs. Clients receive an overall score, component values, and underlying features, to facilitate customized uses.

The model is particularly valuable during earnings seasons, where it captures pre- and post-announcement drift. TrueBeats values are also especially predictive of EPS, Sales, and other metrics for larger, more heavily-covered names.

With moderate turnover and built-in risk neutralization, the Analyst Model offers actionable insights, making it a robust solution across diverse portfolio management approaches.

For more details or to request historical data, please contact us.