Cross Asset Model

- Short horizon alpha derived from options market sentiment for the underlying cash equity (options market tends to lead cash equities market)

- Time horizon: 1 – 5 days

- History: Live since 20170215, in sample from 20050728

- Coverage: ~3,000 US equities

- Delivery: Daily data feed

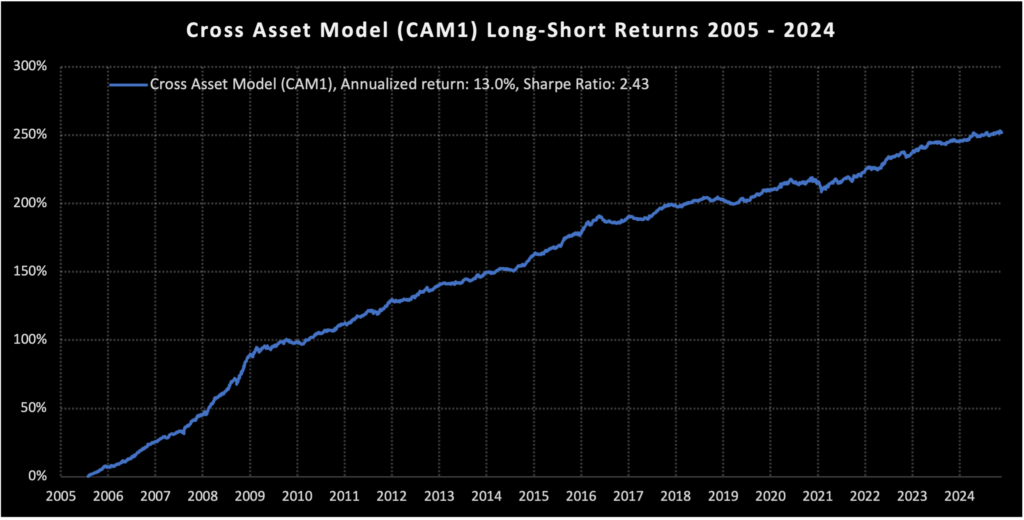

Cross Asset Model (CAM1) is an innovative quantitative stock selection model designed to capture the information contained in options market prices and volumes. The listed equity options market is composed of investors who on average are more informed and information-driven than their cash equity counterparts, due to the higher levels of conviction that are associated with levered bets. As a result we are able to build a unique model which profits from gradual cross-asset information flows.

In historical simulations:

- High-scoring stocks according to CAM1 outperform low-scoring stocks by 13.2% per annum with a dollar-neutral Sharpe ratio of 2.46 before transaction costs

- CAM1 is particularly effective in volatile regimes and for mid- and small-cap stocks

- Best used in conjunction with other alpha signals with similar time horizons.