ESGEvents Library

ESG (Environmental, Social, and Governance) investing has increased in popularity, as well as mandates for socially responsible investing have driven inflows. Most ESG investing, however, has focused on screening out undesirable stocks rather than systematic research into the risk and return characteristics of stocks with varying degrees of ESG exposure. ExtractAlpha’s ESGEvents dataset is designed to help quantitative managers derive measures of company behavior along ESG lines which can both help to satisfy ESG mandates and to build portfolios with favorable risk/return characteristics. ESGEvents also goes beyond traditional ESG measures to identify companies which have actively engaged in political activity, and those which have invested in innovation.

The ESGEvents Library consists of potentially significant company events tied to U.S. companies’ interactions with various governmental bodies. Unlike other ExtractAlpha products, ESGEvents is not (yet) delivered as a stock selection model; in its primary iteration, the dataset describes these events but leaves the implementation in a return or risk prediction framework to the end user.

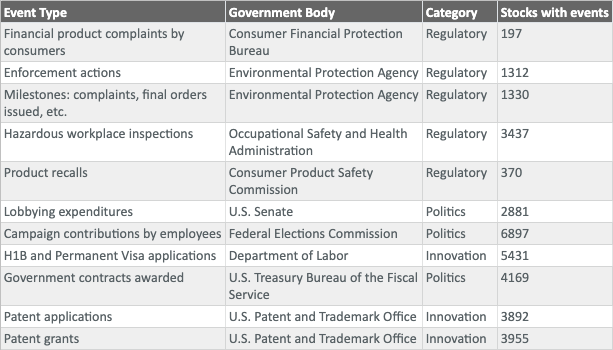

ExtractAlpha has collected these eleven datasets from a variety of public sources, primarily from the websites of government agencies. In most cases the underlying data was not tagged to a traditional company or security identifier such as a CUSIP or ticker, so EA has built a matching algorithm to determine which security was associated with an event at the time of the event’s publication. Furthermore, the datasets vary in the timing of their updates, which are in some cases precisely scheduled and in other cases done sporadically. As such, the amount of ESGEvents data, completeness of the data, and quality of both the company tagging and the historical event timing can vary substantially across the underlying data sources.

Broadly speaking, ESGEvents can fall into three categories:

- Politics – usually positive events showing that a company or its employees are engaging with government policy makers or departments to further their business aims. Example: FEC campaign contributions

- Regulatory- usually negative events relating to a company’s interactions with regulating bodies, often in the form of warnings or violations. Example: EPA inspections

- Innovation – usually positive events showing a company’s investment in innovation. Example: USPTO patent applications

The main ESGEvents file simply consists of security identifiers, dates of the events’ occurrence and publication, and the event types. Detailed files are available for each event type with additional information describing the event.

Updates to the ESGEvents dataset will initially be monthly.

ExtractAlpha will add to the available event types over time, will seek to more fully automate the collection process to increase the frequency of updates, and may also seek to build stock selection or risk models and perform additional research using the ESGEvents dataset. We may also seek to expand ESGEvents coverage outside of the United States in due course.

ESGEvent collection methodology

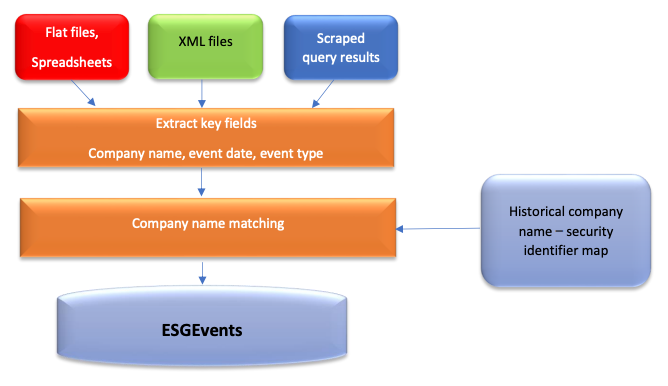

Government websites and data services are not uniform in their data presentation or delivery. Furthermore, formats, field names, and websites change over time. As mentioned before, data is typically not tagged to a particular security. ESGEvents solves these problems with a data collection and cleaning procedure which uses a variety of grabbing, scraping, parsing, and matching techniques to organize these disparate and often disorganized data sets into an easy to use flat file which is tagged to standard listed equity identifiers.