Tactical Model

The ExtractAlpha Tactical Model (TM1) is a quantitative stock selection model designed to capture the technical dynamics of single equities over one to ten trading day horizons. TM1 is a tactical factor, in that it can assist a longer-horizon investor in timing their entry or exit points, or be used in combination with existing systematic or qualitative strategies with similar holding periods.

TM1 expands upon simple reversal factors in several key ways, by identifying stocks which are likely to trend or reverse and by incorporating liquidity and seasonality effects.

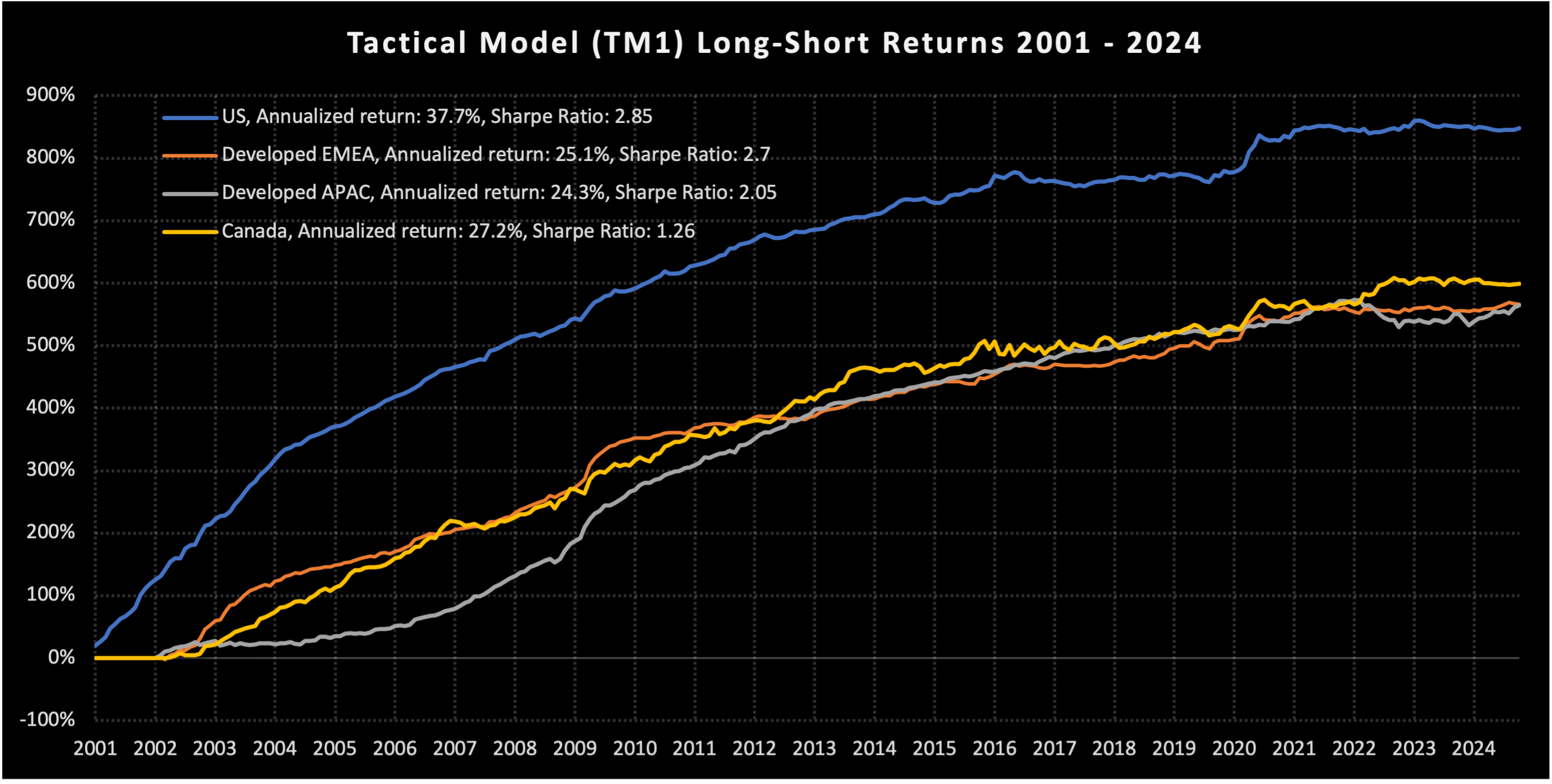

TM1 is available for US and global equities.

In historical simulations, high-scoring stocks according to TM1 outperform low-scoring stocks by 37.7% per annum with a market-neutral Sharpe ratio of 2.85 before transaction costs. Unlike many quant stock selection factors, TM1 exhibits comparable returns for large-cap stocks and small-cap stocks, and is particularly effective in volatile regimes (and even stronger when cross-sectional standard deviation in returns across stocks are high).