The 13F sentiment signal is a long-horizon stock sentiment signal based on quarterly 13F filings:

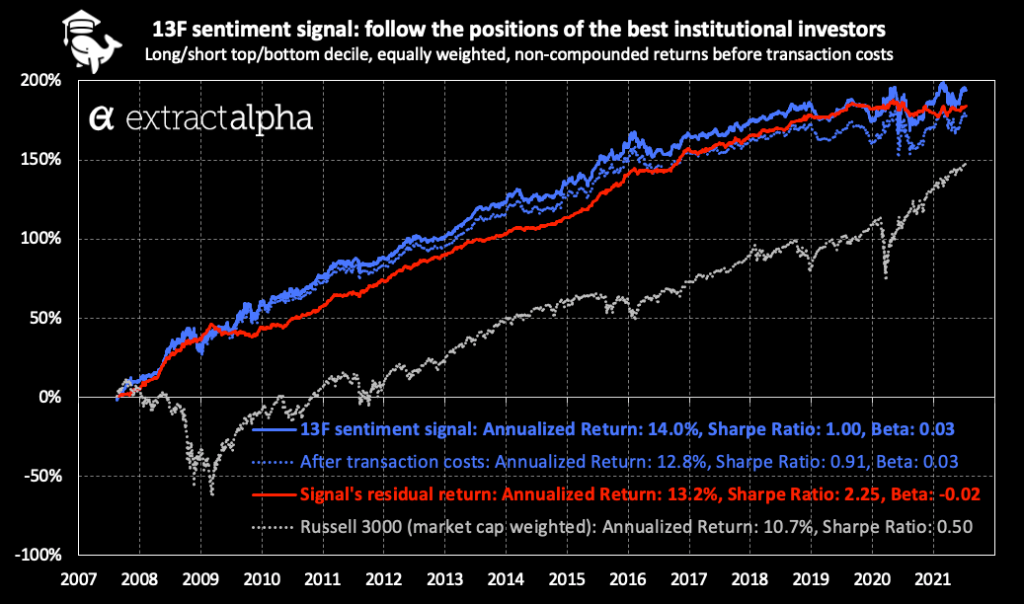

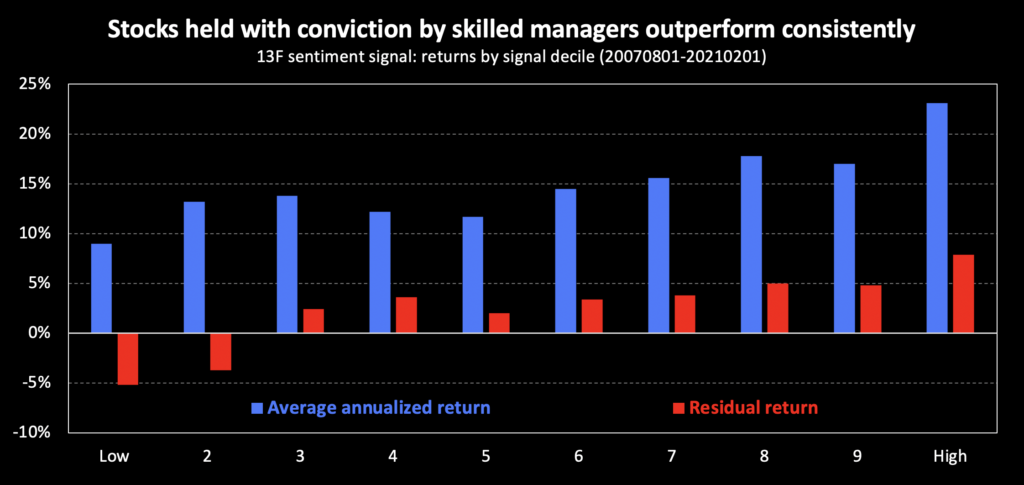

Stocks with the highest sentiment (held with the most “conviction” by managers with the highest “skill”) outperformed stocks with the lowest sentiment by 14% per annum, with a Sharpe ratio of 1.0 and a low daily turnover of only 1.7%

- “Conviction” is identified as periods of abnormal risk-seeking behavior, revealed by trading data

- “Skill” is a proprietary ranking of managers by likelihood to outperform in the current market regime

- (13F is a SEC disclosure of long positions in stocks & ADRs for funds with >$100m USD AUM)

Coverage: ~1500 US stocks (common stock & ADRs)

History: since 20070801

For more information, please refer to our fact sheet.

Contact us and start your free trial to access complete historical data