Unlocking Insights through Unconventional Sources

Data has always been a critical component of investing. Investors rely on data to make informed decisions and reduce uncertainty. Traditionally, investors in China have relied on traditional data sources such as company filings and economic indicators. However, these sources often do not provide a complete picture of a company’s performance, especially in China’s complex and opaque markets.

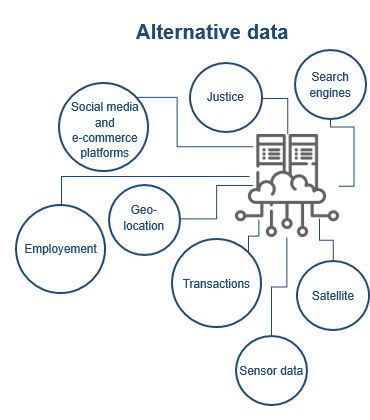

This is where alternative data comes into play. Alternative data refers to information that is generated from non-traditional sources such as social media, satellite imagery, and other unconventional sources. This information is then analyzed to provide insights into a company’s performance or market trends. In China, alternative data has become increasingly popular as it provides insights into a market that is notoriously opaque.

What is Alternative Data?

Alternative data refers to information that is generated from non-traditional sources such as social media, satellite imagery, and other unconventional sources. This information is then analyzed to provide insights into a company’s performance or market trends. In China, alternative data has become increasingly popular as it provides insights into a market that is notoriously opaque.

Importance of Alternative Data in China Industry

Alternative data is important to the industry for several reasons. Firstly, it provides investors with unique insights into a market that is notoriously opaque. China’s regulatory environment can make it difficult for investors to obtain accurate and timely information about companies. Alternative data offers investors a way to understand the performance of companies and industries in real-time.

The Rise of Alternative Data in China

China’s economy has grown rapidly in recent years, and so has the demand for alternative data. One of the driving factors behind this trend is the difficulty of obtaining accurate and timely information about Chinese companies. China’s regulatory environment can make it challenging for investors to access reliable data. Alternative data offers investors a way to understand the performance of companies and industries in real-time and make investment decisions based on more complete information.

Potential Providers of Alternative Data in China

Several providers are offering alternative data services in China. Here are two examples:

Tegus

Tegus is a searchable platform of thousands of peer-led expert call transcripts. The platform provides investors with access to expert insights on public and private companies in China. This data is particularly useful for investors who are interested in understanding the performance of private companies that are not required to disclose their financial performance to the public. Tegus provides detailed information on a range of topics, including supply chain dynamics, regulatory developments, and competitor analysis.

QuestMobile

QuestMobile is a Chinese app data aggregator with more than 700 million mobile devices. The platform provides investors with insights into how consumers are interacting with apps and mobile services in China. This data is useful for investors who are interested in understanding the behavior of Chinese consumers and how they are interacting with different products and services. QuestMobile offers a range of data products, including rankings of top apps by category, user demographics, and user retention rates.

Conclusion

Alternative data is transforming the way investors in China make investment decisions. Providers such as Tegus and QuestMobile are offering investors unique insights into the performance of companies and the behavior of consumers. As China’s regulatory environment continues to evolve, alternative data will become an increasingly important source of information for investors in the country. By leveraging alternative data sources, investors can gain a competitive advantage and make more informed decisions about their investments in China’s rapidly evolving markets.