Introduction

Survey data sets are fundamental tools used across various sectors to gauge public opinion, measure customer satisfaction, and gather empirical research. By systematically collecting responses from a specific group, survey data provides insights that help shape business strategies, policy making, and academic studies. This article explores the intricacies of survey data sets, their sources, the methodology behind them, their applications, challenges, and their evolving role in data-driven decision-making environments.

Understanding Survey Data Sets

Survey data sets consist of information collected through questionnaires designed to capture quantitative and qualitative insights about behaviors, preferences, opinions, and other metrics. These data sets are used to quantify the variability in responses across populations, making them a powerful tool for statistical analysis and informed decision-making.

Key Sources of Survey Data

- Consumer Feedback: Gathered directly from customers in various industries to assess satisfaction and service experience.

- Market Research: Used to understand market needs, assess competition, and identify potential areas of product development.

- Health Assessments: Health-related surveys conducted by medical institutions and public health organizations to track health trends, behaviors, and outcomes.

- Political Polling: Data collected to gauge public opinion on policies, politicians, and elections.

- Academic Research: Surveys conducted within educational frameworks to support scholarly research across disciplines.

Benefits of Survey Data Sets

Enhanced Decision Making

Organizations use survey data to make well-informed decisions that are backed by direct input from their target audience or the general public, reducing the risks associated with guesswork.

Trend Analysis and Forecasting

Longitudinal survey data can track changes over time, providing insights into trends and enabling accurate forecasting in consumer behavior, political opinion, and health metrics.

Targeted Strategy Development

Survey data helps tailor marketing campaigns, political strategies, educational programs, and healthcare initiatives by pinpointing specific needs and preferences of the population.

Policy and Product Development

Feedback from surveys directs policy adjustments and product innovations that are more likely to meet the expectations and address the needs of the end-users.

Methodology Behind Survey Data Collection

Designing the Survey

The first step involves crafting questions that are clear, unbiased, and structured to prevent any ambiguity in responses. Decisions about open-ended vs. closed questions, the scale of responses, and the ordering of questions are crucial for collecting high-quality data.

Sampling Techniques

Choosing the right sample—a subset of the population meant to represent the whole—is critical. This can be random sampling, stratified sampling, or cluster sampling, depending on the survey’s objective and the population’s diversity.

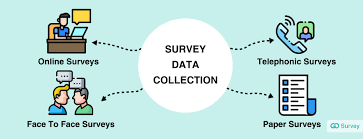

Data Collection Methods

Survey data can be collected via various means such as online surveys, telephone interviews, face-to-face interviews, or paper questionnaires. The choice of medium can significantly affect the responses due to varying degrees of accessibility and respondent comfort.

Data Analysis

Once collected, the data is cleaned for any inconsistencies or incomplete responses and analyzed using statistical software. The analysis may involve descriptive statistics, inferential statistics, or advanced analytics, depending on the complexity of the data and the research questions.

Challenges in Utilizing Survey Data Sets

Response Bias

Respondents may provide socially desirable answers instead of being truthful, which can skew the data and lead to inaccurate conclusions.

Low Response Rates

Achieving a high response rate is often challenging but critical for ensuring the data’s representativeness and reliability.

Data Privacy and Security

Surveys often collect sensitive information, necessitating stringent measures to protect data privacy and comply with regulations like GDPR.

Interpreting Data Correctly

Misinterpretation of survey data can lead to flawed decisions. It requires careful consideration of the context, question phrasing, and the population from which the data was gathered.

Evolving Role of Survey Data Sets

With advancements in technology, the collection and analysis of survey data are becoming more sophisticated. The integration of artificial intelligence and machine learning is enhancing the way survey data is processed and interpreted, making it possible to extract deeper insights more efficiently. Moreover, the rise of mobile and online platforms has expanded the reach of surveys, allowing researchers to gather data more broadly and rapidly than ever before.

Extract Alpha

Extract Alpha datasets and signals are used by hedge funds and asset management firms managing more than $1.5 trillion in assets in the U.S., EMEA, and the Asia Pacific. We work with quants, data specialists, and asset managers across the financial services industry.

Conclusion

Survey data sets remain an indispensable tool in understanding and predicting human behavior and preferences. As organizations strive to become more data-driven, the importance of effectively gathering, analyzing, and applying insights from survey data continues to grow. By addressing the challenges associated with survey data and leveraging new technologies for data collection and analysis, businesses and researchers can uncover valuable insights that drive smarter, more responsive decisions.

Commonly Asked Questions by Data Analysts

- How can analysts improve the quality of survey data?

- To improve data quality, analysts should ensure the survey is well-designed with unbiased questions, target a representative sample of the population, and employ strategies to maximize response rates.

- What are the best tools for survey data analysis?

- Tools like SPSS, SAS, and R provide robust options for survey data analysis, offering a range of statistical techniques to handle everything from basic descriptive statistics to complex multivariate analysis.

- Can survey data be integrated with other types of data?

- Yes, integrating survey data with behavioral data, demographic information, or other relevant data sets can provide a more comprehensive view of the research subject, enhancing the depth and applicability of insights.

- How do businesses handle privacy concerns when dealing with survey data?

- Businesses must comply with data protection laws by obtaining consent from respondents, anonymizing data where possible, and ensuring that data collection and storage systems are secure.

- What are emerging trends in the use of survey data?

- Emerging trends include the increasing use of online and mobile platforms for data collection, the integration of AI for analyzing open-ended responses, and the use of real-time data collection methods to capture more dynamic insights into changing opinions and behaviors.