Quantitative investing isn’t new—but its rise in Europe is picking up serious momentum.

For years, Europe’s financial scene was dominated by discretionary strategies. Investment decisions often came from intuition, experience, and human analysis. But that’s changing. Today, mid-sized funds and asset managers across Europe are embracing data science, algorithmic signals, and predictive models to compete in an increasingly complex marketplace.

Let’s explore how this quant revolution is reshaping European finance—and where Extract Alpha fits into the picture.

What’s Driving the Shift Toward Quant?

Several factors are pushing European investors toward quantitative models:

- Increased data availability: The rise of alternative data—like web traffic, sentiment from earnings calls, and social media—has opened new doors.

- Global competition: As U.S.-based quant funds generate outsized returns, European peers are pressured to keep up.

- Technology democratization: Cloud computing and open-source machine learning tools have lowered barriers to entry.

- Post-COVID urgency: Market dislocations from 2020-2022 created a hunger for models that adapt faster than human decision-making.

Data-Driven Investment Strategies

Quant Hotspots: Europe’s New Data-Driven Cities

While quant finance is spreading across Europe, a few cities stand out as major hubs.

🔹 London

Despite Brexit, London remains a magnet for quant talent. Firms like Citadel Securities and Jane Street continue expanding here, drawn by deep capital markets and a strong talent pool in math, physics, and comp sci.

City of London Financial District

🔹 Zurich

Zurich is where finance meets academia. It’s home to several top research institutes and private banks testing advanced quant models—often blending traditional Swiss conservatism with cutting-edge AI.

Zurich Financial Centre

🔹 Amsterdam

Known for its progressive regulation and low latency infrastructure, Amsterdam has become a European hub for high-frequency trading (HFT) and market microstructure research.

Mid-Sized Funds: From Gut Feel to Quant Focus

It’s not just large institutions going quant. Boutique funds and mid-sized managers are making the shift too.

A standout example is Machina Capital, a Paris-based firm that blends AI with classic valuation. They’re known for using machine learning models that continually adapt to new information—something traditional value models often struggle with the biggest hedge funds in Paris, and who’s hiring

Another is Man AHL, the quant arm of Man Group. They focus on continual innovation and have emphasized the importance of model evolution: “If you stand still, you decay,” said their CIO Russell Korgaonkar.

These firms show that data-driven investing isn’t reserved for tech behemoths—it’s becoming mainstream.

What’s Fueling Alpha in Europe?

Quant investing in Europe looks different than in the U.S. But that’s not a weakness—it’s an opportunity. Here’s what’s working:

🔍 Alternative Data

European managers are increasingly using satellite imagery, shipping logs, credit card data, and multi-language earnings transcripts to gain an edge.

🤖 Machine Learning

Deep learning models are being used to analyze non-linear patterns across asset classes, including small- and mid-cap names where traditional coverage is thin.

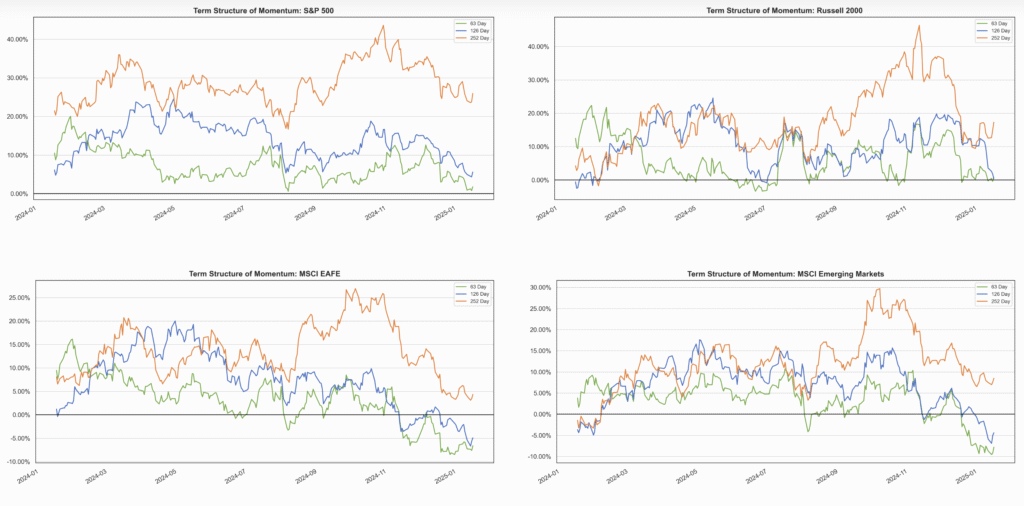

🧠 Smart Signal Engineering

Firms like Robeco are testing new alpha signals under different volatility regimes to ensure they work across economic cycles—not just in backtests (source).

Quantitative Signals Graphic or Dashboard

Understanding Quant Investing Through Visual Insights

For those looking to grasp the core concepts of quantitative investing and its practical applications, the following video offers a comprehensive overview:

This video breaks down complex strategies into understandable segments, making it an excellent resource for readers seeking to deepen their understanding of quant methodologies.

Where Extract Alpha Fits In

At Extract Alpha, we’ve been building quant signals and alternative data solutions that are:

- Proprietary: Our signals are not recycled from common academic research.

- Predictive: They consistently anticipate earnings surprises, sentiment shifts, and valuation reversals.

- Europe-Ready: Our tools now offer pan-European coverage—tailored for the region’s regulatory, linguistic, and market structure nuances.

Explore our TrueBeats Signal, which predicts earnings and revenue surprises—now enhanced for Europe’s reporting timelines.

Learn more from our quant investing blog where we break down recent trends, insights, and backtests shaping the European market.

Need custom signal calibration? Contact us to test our Pan-European Quant Signal Toolkit—built for today’s alpha hunters.

Final Thoughts

The quant revolution is no longer a Wall Street story—it’s unfolding across Europe.

And while the journey from discretionary to data-driven isn’t always easy, it’s rewarding. With the right signals, tools, and mindset, European managers can find inefficiencies that others overlook.

This is where alpha still lives. And it’s just the beginning.

Trading floor or data terminal from a European exchange