Quantitative investing has transformed how many investors make decisions. In the U.S., quant hedge funds like Renaissance Technologies and Two Sigma have used data, math, and machine learning to beat the market. But can these same tactics work in Europe?

The short answer: Yes, but with a twist.

What Is Quant Investing?

Quantitative (or “quant”) investing uses algorithms and data to make trading decisions. Instead of relying on human instincts, quant investors build models that look at:

- Price trends

- Trading volumes

- Company fundamentals

- Sentiment from news or social media

These models are tested on past data and then used to trade automatically or semi-automatically.

Why U.S. Quant Strategies Work So Well

U.S. markets are large, liquid, and data-rich. That makes them perfect for building and running quant models. Here are a few reasons why American quant funds have thrived:

- Consistent regulations: Fewer hurdles across exchanges.

- Big data access: Tons of structured and alternative data.

- Advanced infrastructure: More capital and faster tech.

- Talent density: Top math and computer science talent.

These conditions helped grow a powerful quant ecosystem over the last two decades.

Key Strategies That Took Off in the U.S.

Here are a few quant strategies that saw major success in the U.S.:

1. Factor Investing

Investing based on factors like value, momentum, and size. For example:

- Buy stocks that have recently gone up (momentum)

- Buy cheap stocks with strong earnings (value)

2. Statistical Arbitrage

Traders look for temporary price differences between related stocks or assets. Once prices return to normal, they make a profit.

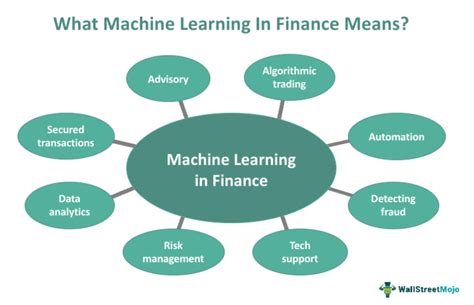

3. Machine Learning Models

Using AI to find hidden patterns in huge amounts of data. This helps spot opportunities no human would notice.

4. Sentiment Analysis

Looking at news headlines, earnings calls, or even Twitter posts to measure how people feel about a stock—and trading based on that.

Further Exploration

For a more in-depth look at these strategies, consider watching the following video:

But Europe Is Different

While these strategies have worked in the U.S., Europe presents new challenges:

1. Market Fragmentation

Europe has many different exchanges—Frankfurt, Paris, Milan, and more. Each has its own rules and fees.

2. Language Barriers

Sentiment models trained on English text may miss insights in German, French, or Spanish content.

3. Regulations Like MiFID II

These rules limit how data can be used and shared. They also make trading more transparent—good for fairness, but harder for some quant strategies.

4. Lower Liquidity

In some markets, it’s harder to buy or sell large amounts of a stock without moving the price.

How Smart Firms Are Adapting

Despite the challenges, many quant teams are finding ways to succeed in Europe.

Here’s how they’re doing it:

- Localized Signals: Tailoring signals to work with European earnings schedules and trading hours.

- Multilingual NLP Models: Using AI that understands French, German, and more.

- Regulatory Intelligence: Designing models that follow MiFID II and other local rules.

- Pan-European Datasets: Building or buying datasets that cover all major markets.

Example: Paris-based hedge fund Machina Capital is blending AI with fundamental research to stay competitive in fragmented European markets.

Extract Alpha: Helping Funds Thrive in Europe

At Extract Alpha, we help quant funds unlock performance through advanced signals and alternative datasets. Our models, once built for U.S. markets, now handle the nuances of European investing.

Use our tools to:

- Backtest strategies across EU and UK stocks

- Leverage multi-language sentiment and forecast data

- Find edge in mid-cap and less-liquid securities

Check out TrueBeats, our EPS/revenue forecast signal now available for European equities.

Why This Moment Matters

European markets are drawing attention. Investment flows are shifting from the U.S. amid volatility, as noted in this Reuters report.

At the same time, hubs like Frankfurt and Amsterdam are turning into tech-quant magnets. This is creating a perfect storm of opportunity—for those ready to seize it.

Final Thoughts

The Wall Street playbook can work in Europe. But you have to adapt. Understanding the regulatory and cultural complexities is key.

I’ve worked with firms that thought a U.S. model would work “out of the box” in Europe—only to get hit with liquidity issues, or miss signals due to language mismatches. Those that took the time to localize their strategy? They’re thriving.