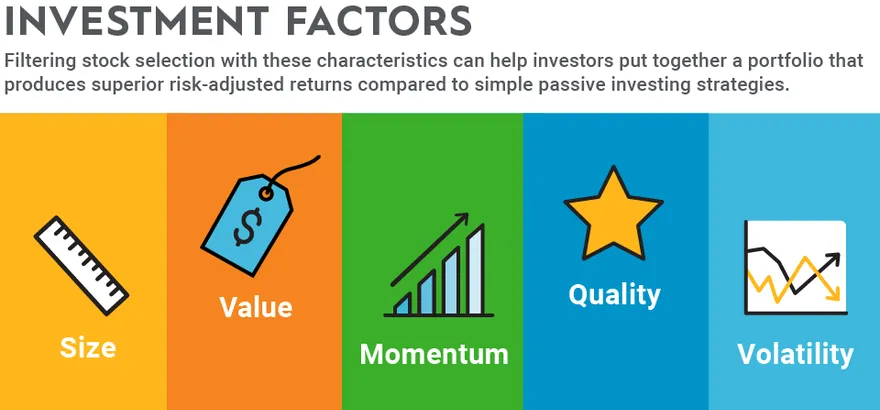

Factor investing has evolved dramatically in the U.S. over the past decade. What began as a focus on classic styles—value, momentum, size—has transformed into a sophisticated discipline using alternative data, non-linear models, and adaptive frameworks.

Now, it’s time for European asset managers to catch up.

While legacy factor models still dominate in many European portfolios, a new era is emerging—one that requires better signals, smarter tech, and more localized data. Here’s how U.S. innovations are shaping the next generation of quant investing, and what European firms can learn.

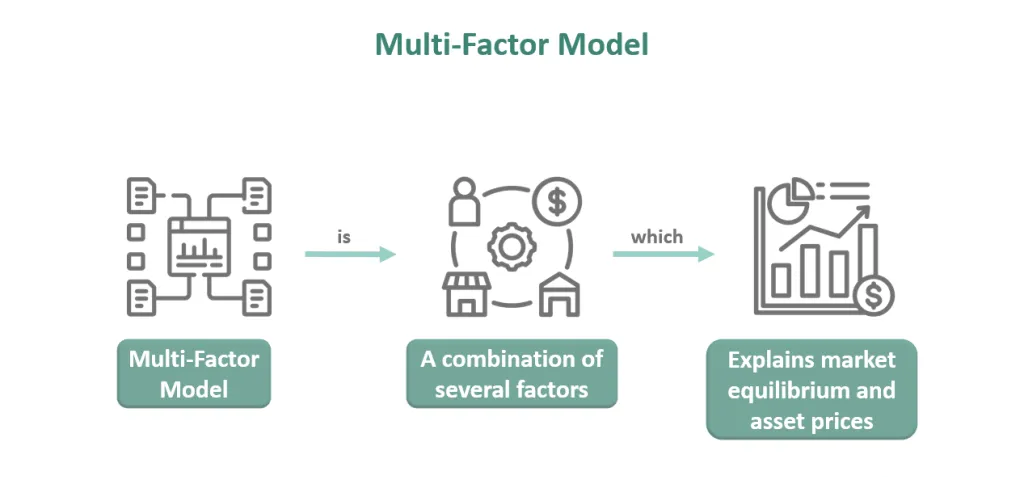

📈 How the U.S. Got Ahead: The Rise of Multi-Factor Intelligence

In the U.S., factor investing 2.0 is built on three big upgrades:

1. Adaptive Multi-Factor Models

Instead of relying on static factor weights, U.S. managers use models that shift based on macro trends, volatility regimes, and earnings cycles. This flexibility has been especially valuable during periods like COVID-19 and the 2022 rate hikes.

Read how MSCI tracks adaptive factors

2. Alternative Data as a Core Input

From web traffic to earnings call sentiment, U.S. quant teams now treat alternative data as first-class citizens in their models. It’s not just for signal enhancement—it’s core to alpha generation.

The Future of Factor Investing

3. Non-Linear and Machine Learning Techniques

These models detect hidden interactions between factors—something linear regressions often miss. Deep learning has enabled context-aware signals that perform better in noisy or fragmented markets.

AI has started a financial revolution – here’s how

🧭 Why Europe Has Lagged Behind

Europe’s financial system brings additional complexity that has slowed adoption of advanced factor models.

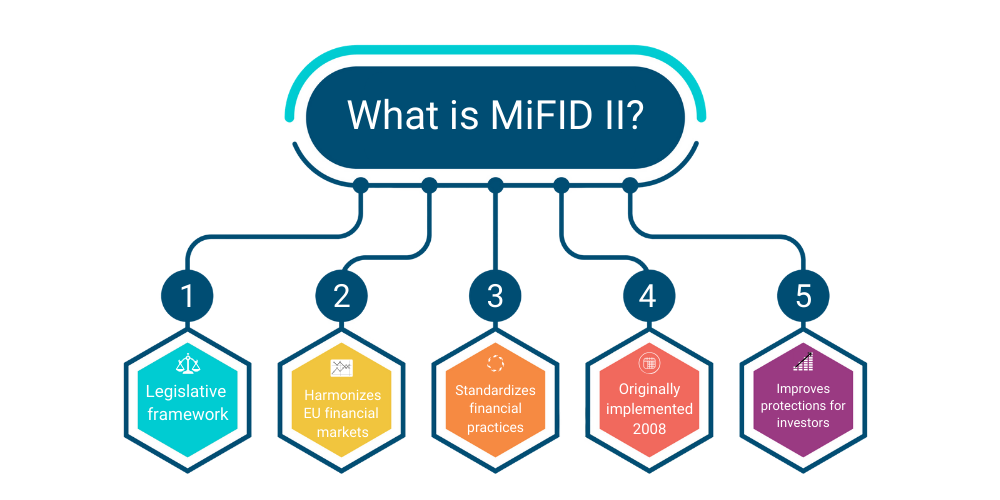

Regulatory Hurdles

MiFID II introduced sweeping changes to data and research—creating compliance friction for quants. It’s also made access to high-quality inputs more expensive.

Fragmented Markets

Unlike the U.S., Europe has multiple exchanges, tax regimes, and currencies. Building cross-border models is harder, especially when sourcing consistent, high-frequency data.

Limited Tech Infrastructure

Many mid-sized funds still rely on outdated databases and siloed analytics, making it hard to ingest or process real-time signals.

💡 Breaking Through Bottlenecks

To thrive in Factor Investing 2.0, European managers must overcome three roadblocks:

- Data Integration: Harmonize traditional and alternative datasets.

- Infrastructure Investment: Adopt scalable platforms capable of supporting advanced quant analytics.

- Talent Acquisition: Build teams that combine financial acumen with Python, SQL, and machine learning expertise

🧠 Where Extract Alpha Comes In

At Extract Alpha, we’ve built a suite of signals designed for this new quant reality—backtested, interpretable, and built for Europe.

What We Offer:

- TrueBeats: Forecasts EPS and revenue surprises, now calibrated for European reporting cycles.

- Pan-European Signal Toolkit: Cross-listed and multi-language datasets tailored to MiFID II constraints.

- Analyst Model: Incorporates consensus revisions and proprietary adjustments to deliver a deeper edge.

Explore more in our quant insights blog or dive into our ExtractAlpha Retrospective for real-world alpha generation stories.

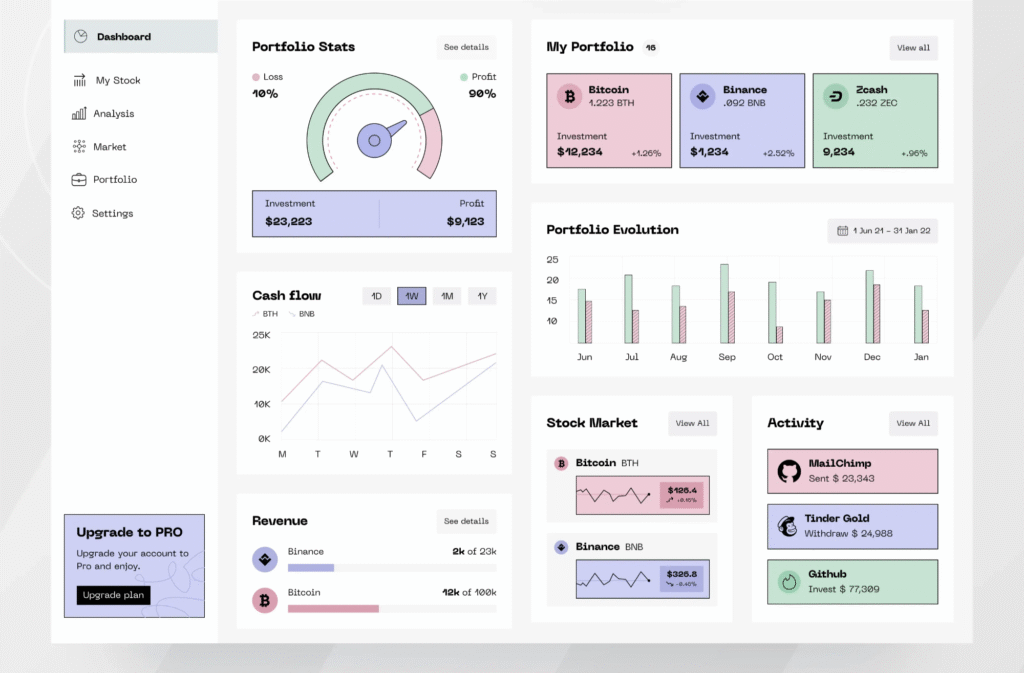

📊 Backtest Your Edge

Curious how our signals perform on your portfolio?

Let us run a custom backtest across your European equities universe—designed to identify performance drivers and signal sensitivity under different market regimes.

Contact Extract Alpha to schedule a walkthrough.

🧩 Final Thoughts

U.S. quant shops didn’t just get lucky—they innovated early. European asset managers now face the same pressures—and the same opportunities.

Factor Investing 2.0 is already here. With the right tools and mindset, European firms can lead the next chapter of data-driven alpha generation.

The question is no longer if to adapt—it’s how fast.

MiFID II – Regulatory Data