by Vinesh Jha, ExtractAlpha founder and CEO

The ExtractAlpha earnings surprise model suggests that fundamentals in China are even more dire than the sell side thinks.

With the recent turmoil in the China A Shares market, it seems that sell side analysts have reason to be skeptical about the fundamental strength of corporate earnings in the Mainland. But is even *more* skepticism warranted?

Here we look at ExtractAlpha’s TrueBeats, which is a model designed to predict earnings surprises, and which has been consistently accurate across global markets. The model builds its predictions by focusing on the analysts with the best track records; by looking at surprise trends in companies and their peers; and by measuring corporate management behavior through metrics like guidance and late reporting.

If we see a negative TrueBeat value for a particular company, our model is expecting earnings to come in even lower than the typical analyst forecast. This is pretty rare in most markets, where management sandbagging and analyst-company relationships help to engineer positive earnings surprises for most companies.

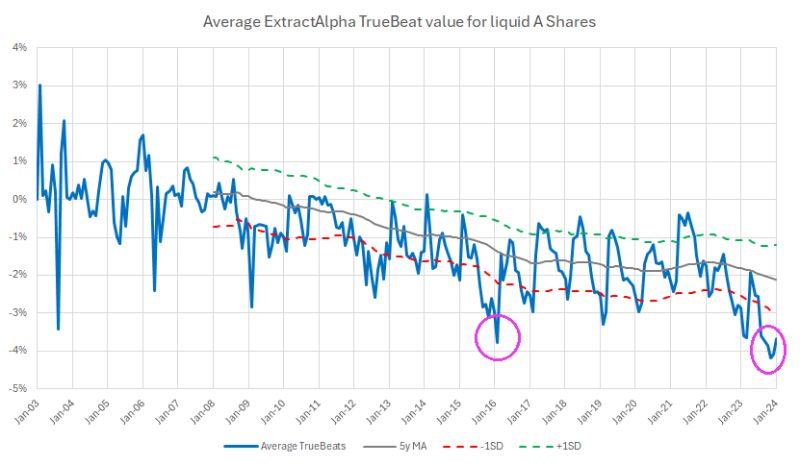

The chart below plots the average TrueBeats values across all liquid A Shares for the last 21 years. The sell side has been consistently too optimistic on China since about 2011, with a secular downtrend, and there’s been an acceleration recently. Our model predicts that even the *average* A Share name will come in 4% below sell side forecasts lately. That’s the lowest in the last 20 years!

It’s similar in magnitude and also Z-score (relative to a 5 year moving average) to what we saw in the last major turmoil back in late 2015 – early 2016.

A research piece we published last year showed that TrueBeats, aggregated to the country or industry level, can be effective tools in systematic asset allocation. Please contact us with any questions.