Earning surprise is a phenomenon that occurs when a company’s actual earnings for a particular period differ significantly from the estimated earnings by market analysts. It is a significant metric that investors use to evaluate a company’s financial performance.

Understanding Earnings Surprise

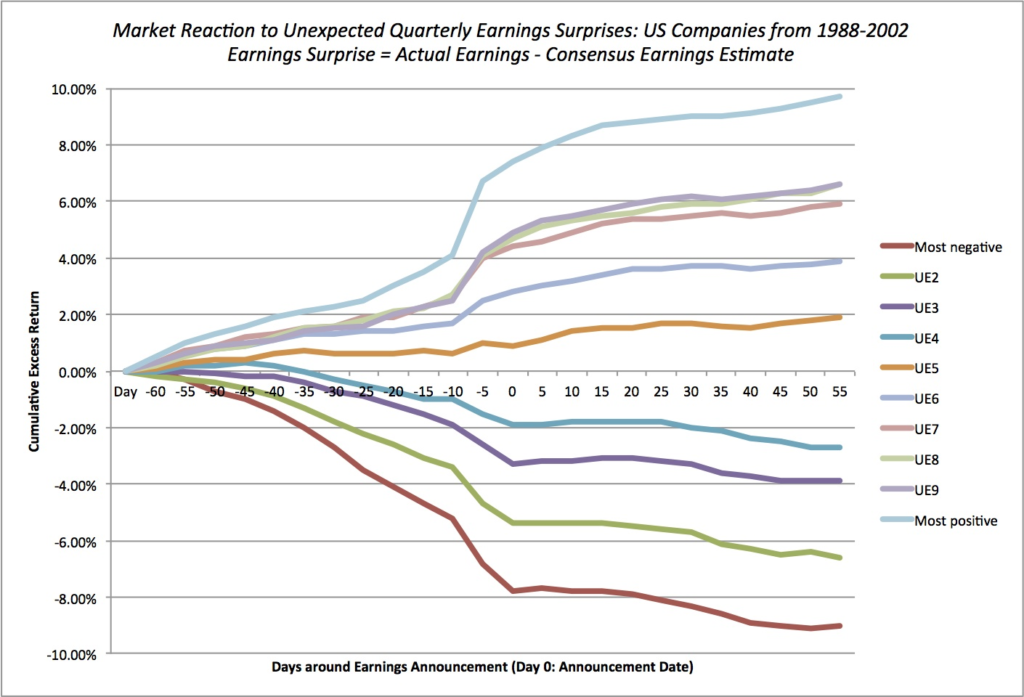

A metric that measures the difference between the actual earnings reported by a company and the earnings that were expected by the market analysts. A positive earnings surprise means that the company has performed better than expected, while a negative earnings surprise means that the company has performed worse than expected.

Investors use earnings surprise as an indicator of how well a company is performing relative to market analysts’ expectations. A positive earnings surprise can lead to an increase in a company’s stock price, while a negative earnings surprise can lead to a drop in the stock price.

Impact on Stock Prices

A positive earnings surprise can lead to an increase in the stock price, while a negative earnings surprise can lead to a drop in the stock price. This is because earnings surprise provides valuable information to investors about the company’s financial health and future prospects.

A positive earnings surprise indicates that the company is performing better than expected, which could lead to an increase in investor confidence in the company’s future prospects and, consequently, an increase in the stock price. On the other hand, a negative earnings surprise suggests that the company is not performing as well as expected, which could lead to a decrease in investor confidence and a drop in the stock price.

Factors Affecting

Including changes in market conditions, unexpected events, and changes in the company’s management. Additionally, companies that consistently beat earnings expectations may have higher stock prices, while companies that consistently miss earnings expectations may have lower stock prices.

Market conditions can influence this, with changes in the economic environment affecting the company’s performance. Unexpected events such as natural disasters, pandemics, or changes in government policies can also impact a company’s earnings.

Conclusion

This is an essential metric that investors use to evaluate a company’s financial performance. Understanding earnings surprise and its impact on stock prices can help investors make informed investment decisions. It is crucial to keep an eye on the earnings reports of the companies that you invest in to avoid any unpleasant surprises.